Equistone Partners Acquire Averys

Acquirer

Equistone announced today an agreement with LBO France for the acquisition of Averys Group, a European leader in the production of metallic racks and furniture. The transaction is likely to be finalised in the coming months.

In 2013, under the direction of LBO France, Averys completed a transformational build-up with the acquisition of Stow, a leader in static racks and storage systems with a major production facility in Belgium. In addition to their operational synergies, Averys and Stow also complemented each other geographically. Through this major acquisition, Averys doubled in size, becoming the second largest group in the industry in Europe.

With sales of approximately €350 million in 2014, the group enjoys positive organic and external growth prospects. In particular, Averys is considering targeted acquisitions to strengthen its position in key European markets where it is currently less well represented. The group is also looking to step up its development in geographies outside Europe.

Laurent Mabileau, Director with LBO France, declared: “We are proud to have accompanied Averys and its management since 2008. Over this period, Averys has become a true European leader with two-thirds of its activity outside of France and strong growth in Asia. The successful refinancing of €165 million of debt in October 2014 is a sign of the positive execution and integration of Stow within the group. Today, Averys is perfectly positioned to continue its development, particularly in view of further consolidation in the sector.”

Guillaume Jacqueau, Managing Partner of Equistone Partners Europe, pointed out that: “We are looking forward to supporting Averys Group in its new phase of development. The performance of recent years has confirmed the relevance and resilience of its business model. We are convinced that Averys offers strong growth potential, both internally and externally, and will endeavour to step up implementation.”

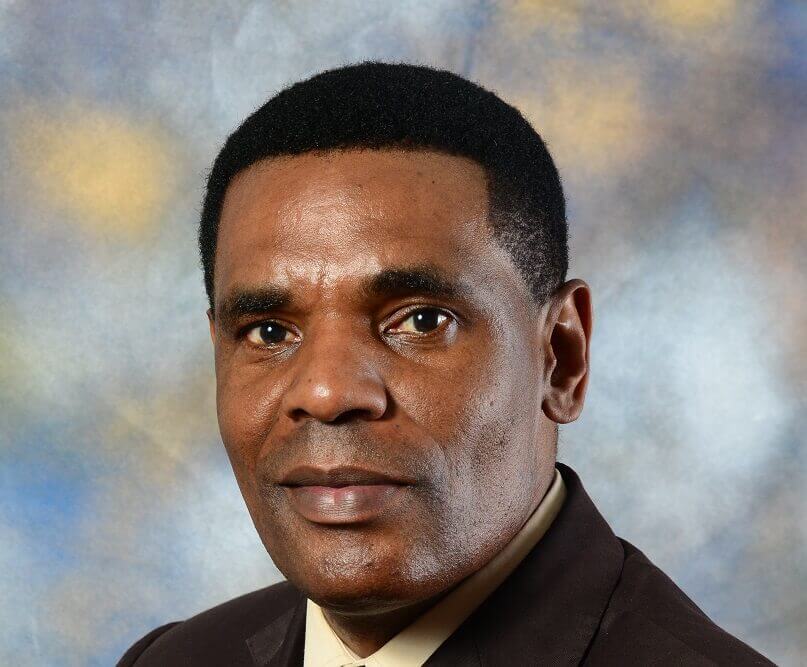

Jean-Dominique Perreaux, CEO of Averys, concluded: “We welcome Equistone’s decision to acquire a stake in the capital of Averys, which will help continue the internationalisation of our business. We are grateful to LBO France for its support over the past six years, and are confidently setting off on this new stage of our development with Equistone, a prime partner to implement our ambitious investment programme for organic and external growth.”