Pay suppliers, vendors and any open invoice directly to any bank account.

PaymentEvolution, Canada’s leading provider of payroll and payment services, introduces Business Payments. Businesses can now send and receive payments electronically through direct deposit, in just a click of a button.

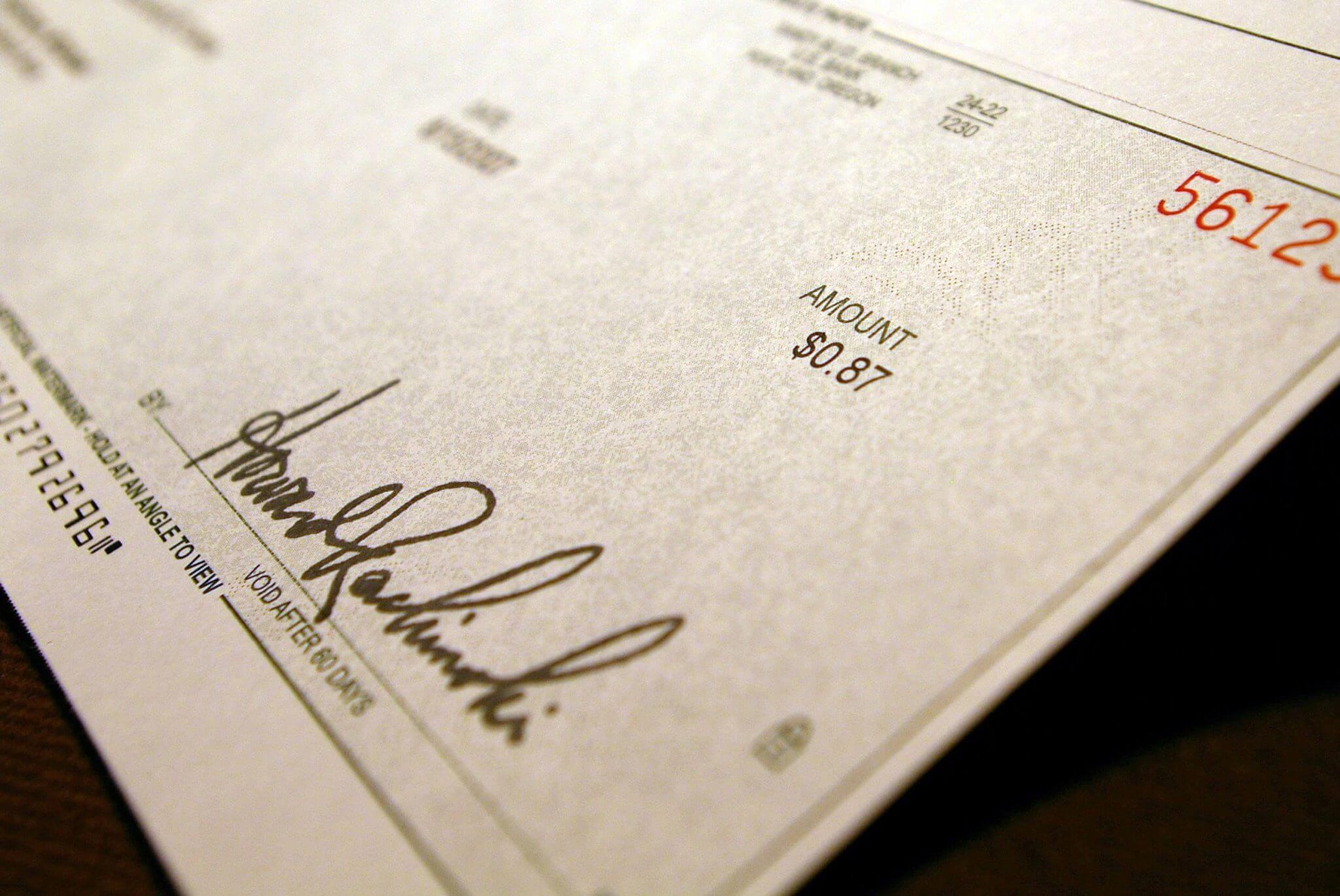

“Cheques are frustrating. They get ‘lost in the mail’, need to be reissued and are a pain to deposit. Business Payments by PaymentEvolution eliminates the need for cheques and allows you to pay your contractors, vendors and suppliers electronically – direct to their bank accounts” said Sam Vassa, CEO of PaymentEvolution. “By scheduling your payments, you can better control your cash flow and pay your suppliers on time. No more wasting time writing cheques, stuffing envelopes or mailing payment notices – it’s all electronic and fully reconciled with your accounting system. Your bookkeeper or accountant will thank you.”

When signed into their PaymentEvolution account, companies can exchange bank account details of where to send and receive the payments. Open invoices and payables from a connected accounting system are then automatically shown for payment approval. Maintaining full control, company officers can schedule and process payments for only $0.85 per transaction. No more printing cheques, mailing remittances or worrying about accounting reconciliation. Business Payments by PaymentEvolution saves you time, money, and allows you to focus your attention on more pressing issues.

“Using Business Payments is safer than issuing a cheque. Electronic payments are fully tracked giving you assurance that payments were made on time. Cheques are inconvenient and the growing occurrences of cheque fraud have left many businesses reluctant to accept them anymore. Direct electronic payments are more secure and cost effective.”

The new payment technology is supported by all financial institutions in Canada and is available now to PaymentEvolution clients.