2016’s Most Innovative Hedge Fund Manager, France

La Française Investment Solutions (“LFIS”) is an institutional asset management boutique established in 2013 and based in Paris, France. Together with La Française Bank, Paris branch, LFIS makes up La Française Global Investment Solutions (“LF GIS”), the investment solutions business line of French asset manager La Française Group. LF GIS combines investment banking and asset management expertise and offers a range of investment solutions including hedge funds and dedicated solutions and has seen strong growth since inception with assets currently at $6.5 billion and more than 38 professionals.

LFIS takes a nimble, cross-asset approach to deliver innovative funds including alternative strategies focused on credit and risk premia, solutions funds including hedged equity and enhanced volatility products and dedicated solutions. LFIS’s offer is aligned with the needs and constraints of today’s institutional investors.

Luc Dumontier, Head of Factor Investing and senior Portfolio Manager at La Française Investment solutions comments the “factor investing” phenomenon and presents LFIS’s differentiated offer.

Why investors are so interested in the “factor investing” approach?

Investors have realized that most funds tend to be exposed at best, in benign conditions, to very few risk factors; and at worst, in times of risk aversion, solely to equity risk and thus correlated to market fluctuations. This explains the emergence of risk parity solutions from 2008 that force the diversification to be effective between two historically uncorrelated factors, being equities and government bonds. However, a risk parity allocation, which corresponds to a capital allocation of 15% to equities and 85% to bonds, is ever less appealing given the low level of yields.

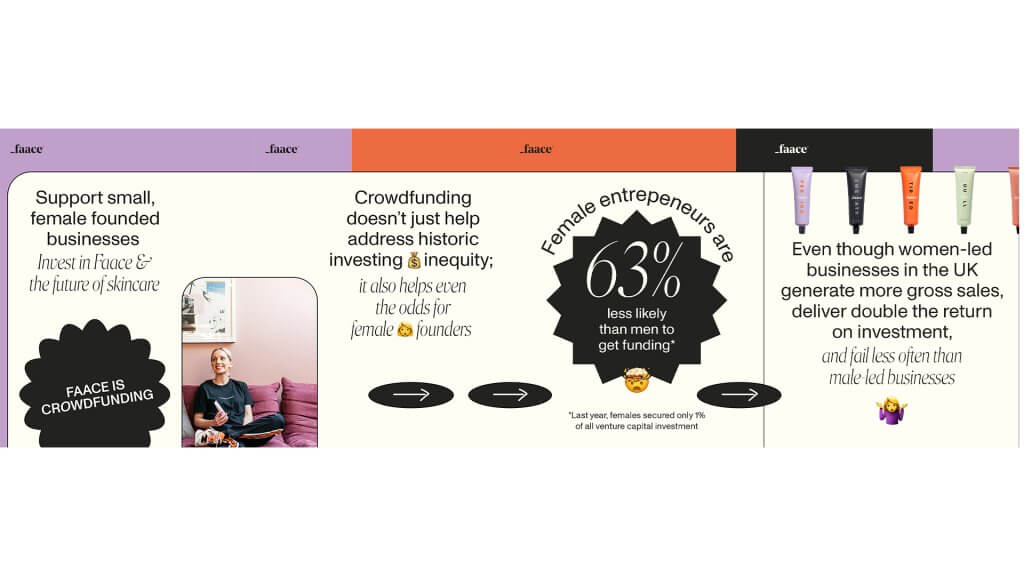

Investors also realized that most funds that succeed to beat their benchmark were biased to other factors such as buying the cheapest stocks based on their valuation multiples (value) and the smallest in terms of capitalization (size) for equity portfolios. It was enough to convince investors to directly expose their portfolios to such factors.

Can you tell us more about these factors? Why is it interesting to combine them?

The classical premia approach combines different long/short portfolios which capture the standard alternative factors (value, carry, momentum, low risk) well documented by academics. The factors are implemented across a broad allocation of traditional asset classes (stocks, bonds, currencies and commodities).

These factors are expected to deliver returns linked either to additional structural risk (risk premia) or by putting in place strategies that profit from biases linked to market participants’ behaviour, investment constraints and structural flows (style premia).

The rationale behind each of these premia being different is that they are supposed to deliver returns that are less correlated with each other and underlying asset class and so they can serve as blocks to build portfolios expected to deliver strong Sharpe ratios.

Did these solutions have managed to stand out in terms of return and diversification?

According to numerous simulations done by both academics and investment banks, these solutions would have allowed investors to achieve regular returns and mildly correlated with asset classes over the past two decades. However, since the launch of the first “style premia” solutions in 2013, the reality has been a long way from this idyllic fiction: they have delivered modest average returns and often correlated with the equity markets.

What are your recommendations to achieve stable returns using such framework?

We urge investors to only select robust premia, being those that are understandable, really diversifying and built avoiding over-fitting. Then, it seems crucial to capture other types of premia than the academic ones that are implemented by ever more investors. This diversification can be done using other investment horizons (e.g. medium-frequency strategy that exploit short-term over-reactions) or other asset classes (e.g. volatility, insurance-linked securities and arbitrage strategies). Also, we recommend avoiding factor timing that have proved to be difficult historically. We would rather encourage investors to use allocation techniques that result in highly diversified portfolios among factors (e.g. equally risk contributed) to make the most from their diversification power.

Can you present us your premia offer at La Française Investment Solutions?

We are part of the precursors in this investment space with the launch of LFIS Vision – Premia Opportunities (SIF format) at the end of 2013. One year later we launched a UCITS format (end of 2014).

Our strategy goes far beyond the traditional approach that consists to only combine the classical academic premia (value, carry, momentum, etc.) within the major asset classes. We have built a team of fund managers with different backgrounds – from asset management to investment banking – so to be able to expand the investment universe to 2 other premia families – implied parameters and carry liquidity.

All premiums are selected using the same strict range of criteria, including the ability of the fund managers to explain the rationale behind the premia and its capacity to bring a real diversification power at the fund level. This very wide range of premia (up to 30) allows both funds to target a Sharpe ratio of 1.5, with an average volatility of 7% for the SIF fund and an average volatility of 5% for the UCITS fund.

The results are above expectations as both funds registered a Sharpe ratio higher than 2 since their respective launches with a strong consistency over time: 6.5 % in 2014, 9.1 % in 2015 and 5.3% in 2016 (as of April 2016) for the LFIS Vision – Premia Opportunities fund. The UCITS fund delivered 5.9% in 2015 and is up 3.9% in 2016 (as of April 2016).Company: La Française Invesment Solutions

Company: La Française Invesment Solutions

Name: Luc Dumontier, Head of Factor Investing and Senior Portfolio Manager

Email: [email protected]

Web: www.lafrancaise-gis.com

Address: 128, boulevard Raspail, 75006 Paris

Phone: 33 1 44 56 10 00