Extracting Value from Sustainability Requirements

Don’t gamble on waiting for regulation to require you to run a sustainable business. Start differentiating your business now.

‘Socially Responsible Investment’ has been slowly creeping into the high-finance lexicon, and corporate finance – initially the most sceptical of sectors – appears to be waking up to this unavoidable progression. Unsurprisingly, considering the industry’s emphasis on the bottom line, some might wonder if the new interest in Environmental, Social and Governance (ESG) issues is mere ‘green wash’. But for whatever reason, ESG considerations are increasingly coming into play for most sectors.

‘Sustainability’ is not about “being green”. Environmental, Social and Governance (ESG) will drive greater efficiency, less waste, enhanced reputation management and company ethos, transparent governance; all these, and other outcomes, generate positive outcomes for the business as it grows and develops. For those investors and ‘money men’ who doubt this – think of the potential for ESG implications arising from your portfolio. Caring about the dirty deeds and corporate responsibility of companies involved in the portfolio could be basic damage control by those who want to avoid reputational risk. But in reality, when done properly, the benefits are much more tangible:

– Enhanced long term financial viability of portfolio

– Enhanced long term performance of portfolio

– Increased market value

– Maximised exit position

– Enhanced synergies with ESG sensitive funds / businesses

– Reduced or eliminated dissonance with new market sectors

Grab the Initiative to Differentiate

Your Business Customers, investors, employees and other stakeholders want to know more about their companies’ business models, operating practices, performance and long-term viability. A more effective approach to these issues requires positive risk management. It is a sure way to assess and promote the desired outcome.

Stakeholder groups all want to understand how firms

may:

– Create genuine and sustainable value;

– Create meaningful, empowering employment in safe and healthy environments;

– Contribute positively to the communities in which they operate;

– Continue to develop long term, sustainable business environments through increased innovation, appropriate use of technology and

process enhancement; and

– Reduce their environmental footprint and contribute positively to the biosphere.

Companies that are able to master the challenges are likely to have a long-term advantage. Waiting to change will prove to be a myopic view.

Businesses looking to chart a clear path should craft a repeatable and meaningful process. The true commercial value lies in doing this because it is only the business who genuinely understand the value and positive impacts it can create. Those who merely seek to ‘tick a box’ will soon be exposed as simply doing that. Given the increasing wave of commercial, social and regulatory pressure – why would any firm want to be perceived as an ‘outlier’?

How to Start? Firms should view this as an opportunity, rather than a chore. Understanding the risks and opportunities will drive out inefficiency and stimulate innovation. By focusing on these fundamentals, companies can address the rising expectations and be prepared when sustainability reporting becomes standard practice. It starts by fully understanding the underlying business model – not the business plan – and the dynamics and ‘levers’ involved in managing each of the following: –

– What problems do you solve for your customers?

– What value do you deliver to your customers?

– What resources do you need?

– How do you deliver your services / products?

– How important is customer loyalty – and how do you achieve it?

• What are the cost structures and revenue streams

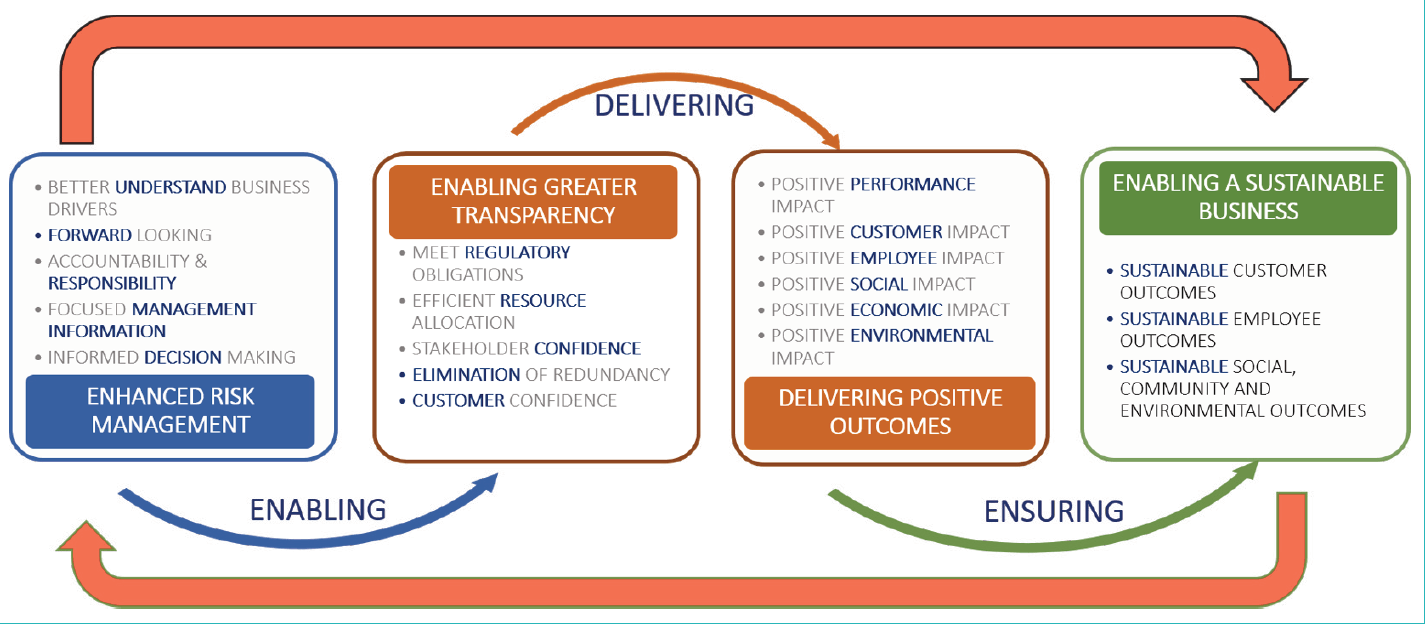

Too often risk management is viewed as a ‘cost of compliance’, or a ‘business prevention’ function. This makes true integration and embedding difficult to achieve. Take an alternative view however, then risk management, when done properly, is actually a highly positive business enabler. It is critical to support the delivery of business objectives for any firm, in any sector. It becomes more ‘management’ than ‘risk management’ and supports the efficient and sustained viability of any business. Risk Strategy should be designed to assist the business in the achievement of its objectives. It should do this not through risk avoidance, but through the embedding of a framework through which it can identify and manage its risks to an acceptable level (its ‘risk appetite’).

This strategy ensures that the risk management programme is aligned to delivering its business objectives and intended outcomes and is company – wide; including third parties such as outsource service providers. There is no consensus yet as to what ‘good looks like’. The reality therefore is that most firms are potentially missing their obligation, or more importantly, missing the real point. Introducing the mind-set of the cyclical and linked nature of the process outlined above is a significant start.

IT Works

Several studies have found a positive correlation between companies that disclose their sustainability efforts and the companies’ value. Companies have also found that, while sustainability reporting enables them to meet increasingly focused stakeholder and customer expectations, it also provides a framework that helps guide decision- making, investing, and business planning. Such firms would argue that they better understand not only what can go wrong – but what needs to go right. A good definition for risk management.

Ford Motor Company has been sharing information on its sustainability activities for nearly 20 years, and its executives believe that the reporting helps to focus the company’s strategic thinking. In its 2013- 2014 sustainability report, Ford said, “Sustainability reporting not only demonstrates transparency but, in our view, is the basis of organizational learning, demonstrates our values, and both reflects and drives outstanding economic, environmental, and social performance.”

Unilever notes that its Sustainable Living Plan “is our blueprint for achieving our vision to double the size of the business, whilst reducing our environmental footprint and increasing our positive social impact”. The company is committed to offering a transparent account of its sustainability progress each year, with reports aimed at a broad range of audiences including opinion leaders in both sustainability and business responsibility.

Don’t Gamble by Becoming an Outlier – Take Action Now

Don’t wait to be told. Seize the initiative within your business. Generate real competitive advantage. Demonstrate effective sustainability and work with external groups who can generate real multipliers from your support for their environmental or social agenda. We all win.”

Company: Crowe Horwath

Name: Neil Mockett

Email: Neil.Mockett@

crowehorwathgrc.com

Web: www.crowehorwath.net

Address: Carrick House,

Lypiatt Road, Cheltenham

GL50 2QJ

Phone: 01242 234421