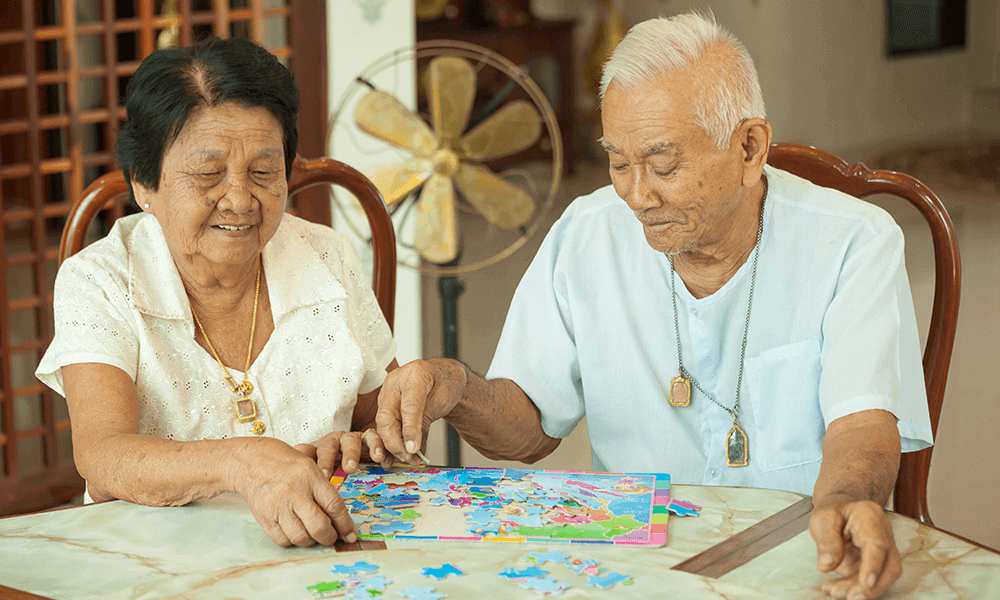

Welltower Inc. today announced it has completed the previously announced acquisition of the Vintage Senior Living portfolio for a purchase price of $1.15 billion. The 19-property portfolio offers a combination of independent living, assisted living and memory care in premium locations concentrated in Southern and Northern California, including the Los Angeles and San Francisco metro markets.

“The addition of this portfolio further solidifies Welltower’s position as the largest owner of premier seniors housing properties in the United States and furthers our strategy to focus on top metro markets with high barriers to entry,” said Tom DeRosa, Chief Executive Officer of Welltower. “Combining this portfolio with transactions announced through June 2016, Welltower has completed over $1.5 billion of seniors housing investments year-to-date.”

Welltower is transitioning management of these communities to three of its best-in-class operating partners based, in large part, on property locations, community size and unit mix:

Senior Resource Group (SRG) will operate eleven (11) communities, representing 1,705 units, the majority of which are independent living and assisted living. Founded in 1988 and headquartered in Solana Beach, California, SRG is an award-winning, fully integrated developer, owner and operator of senior living communities. Over 4,000 seniors, primarily in California, currently call an SRG community their home. Including this acquisition, Welltower will have approximately $1.3 billion of investments with SRG.

Sunrise Senior Living, which is Welltower’s largest seniors housing operating partner, will operate seven (7) communities, representing 806 units, offering residents independent living, assisted living and memory care options. Founded in 1981 and headquartered in McLean, Virginia, Sunrise Senior Living operates more than 300 communities in the United States, Canada and the United Kingdom, with a total unit capacity of approximately 28,400 including 50 communities in California with a unit capacity of 4,027. Including this acquisition, Welltower will have approximately $5.2 billion of investments with Sunrise Senior Living.

Silverado Senior Living will operate one (1) community, representing 79 units that will be converted exclusively to memory care. Founded in 1996 and headquartered in Irvine, California, Silverado Senior Living is a privately held company that is nationally recognized as a leader in memory care. Silverado currently operates 31 communities, primarily on the West Coast. Including this acquisition, Welltower will have approximately $0.4 billion of investments with Silverado.