Can Toshiba Survive Yet Another Blow? Maybe PwC Holds the Key

Just as industry giant Toshiba battles to overcome one financial woe, another strikes them where it hurts, and that would be their bottom line. It seems like the beleaguered multinational conglomerate of Japanese origin has been battling crisis after crisis in recent years and there is some concern that the company may be standing on its last legs. However, even though the electronics giant failed the mandated audit by PwC (PricewaterhouseCoopers Aarata), it could just be that all is not lost. Perhaps what the auditor is doing will actually work to the benefit of the embattled conglomerate on more than one level. It could just be that a little more transparency resulting from an audit may restore public confidence where it counts – their pockets!

Rumours of Accounting Irregularities

In a blow that hit the company hard in late 2015 and early to mid-2016, it was being whispered (a very large whisper at that) through the grapevine that there were significant accounting irregularities attributed to Toshiba’s annual reports on several of their holdings. Those rumours were soon to be the downfall of at least one of their global companies and as the news snowballed around the globe, investors became wary and stocks began falling at breakneck speeds.

It was being said that the company had perhaps not been completely honest in earnings reports so as not to frighten off stockholders and future investors and so an audit was called for. Although Toshiba tried to forestall their annual earnings report this spring, PwC said ‘No go” and the report would be made public. However, this might not be totally bad for the embattled corporation.

By this time, everyone knows they are in financial hot water, are losing money on several fronts, are selling their beloved chips division and are having difficulty raising the funds they need to turn their enterprise around. A little transparency might just go a very long way once interested parties understand where the problems lie. New money might turn the company around once confidence is restored.

Key Losses in the News

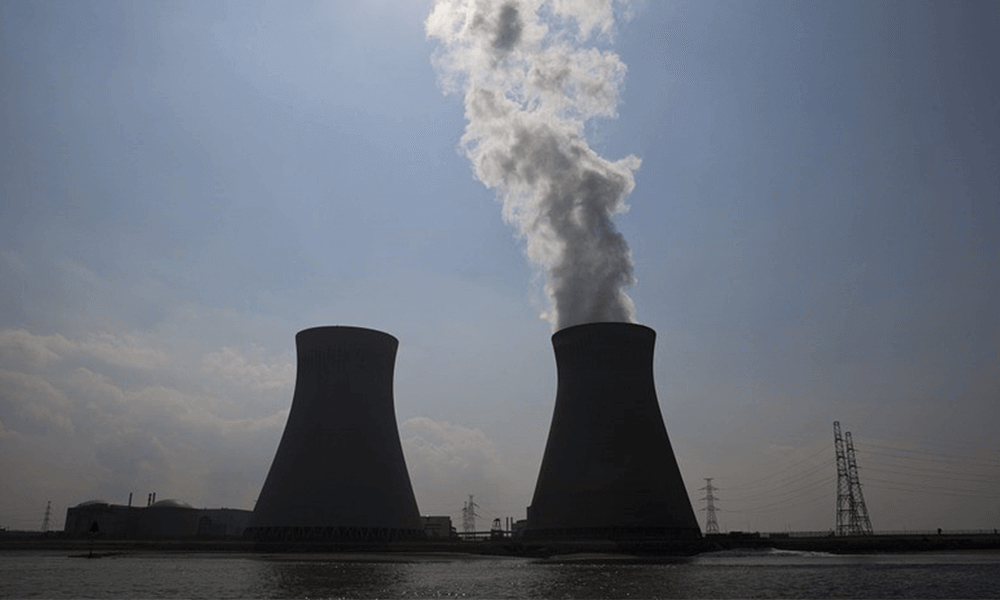

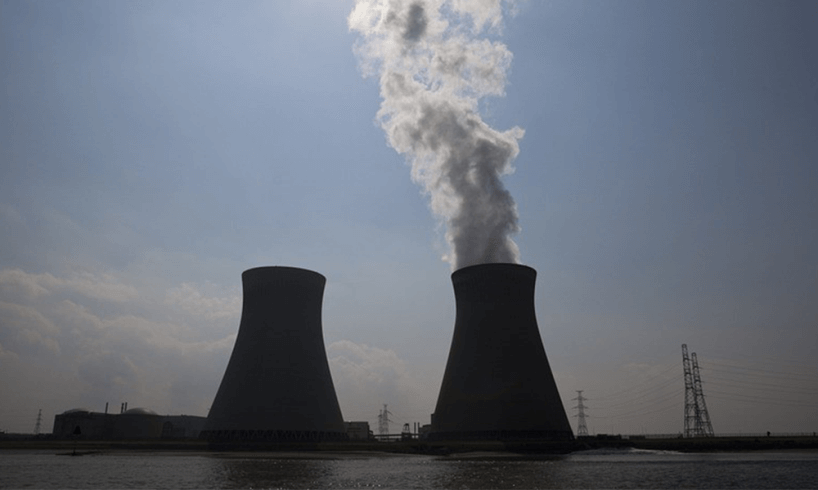

One of the biggest problems now besetting Toshiba is the massive losses they face from the acquisition in the United States nuclear sector. Their announcement came in late December, just days after Christmas, and stated that the industry giant might need to write off several billion USD. Following on the heels of controversy over the company’s lack of disclosure on earnings, the market was shaken and stocks immediately began plummeting.

The Intent of the Audit and Possible Outcomes

While it is understood that investors and lenders who had a stake in the conglomerate demanded an accounting of financials that had not been forthcoming, respective governments where Toshiba has holdings wanted to get a good look at those financials as well. Taxes are nothing to play with and the only way to know what a company truly owes is to weigh losses against profits for that all-important taxable bottom line. PwC denied postponing the report, which Toshiba had requested, but again, all is not lost. Even though massive losses are expected to be documented and the company is still expected to sell its chip division to recover billions on the transaction, the auditors may have just ignited a fire of hope for the future of the company.

What Does the Future Hold for Toshiba?

It was necessary to get a realistic handle on the state of financial affairs in which Toshiba became mired, but that very same audit can lead to avenues of recovery. After having suffered an auditing scandal in 2015, it was imperative that Toshiba be forthcoming with financials this time around. The future remains grim, but auditors have the ability to analyse current finances, advise liquidation where necessary, and can then help Toshiba turn itself around to get back on track to being the industry giant it once was. Only an accurate analysis of financials can get the ball rolling and now the auditor is at bat.

The future does look grim with so many losses in such a short time period, but recovery is still not out of the question. Until that report is released, however, it’s still anyone’s guess what that future might be.