Russia’s investment will ensure stable supply of Russian crude through 2021, says GlobalData

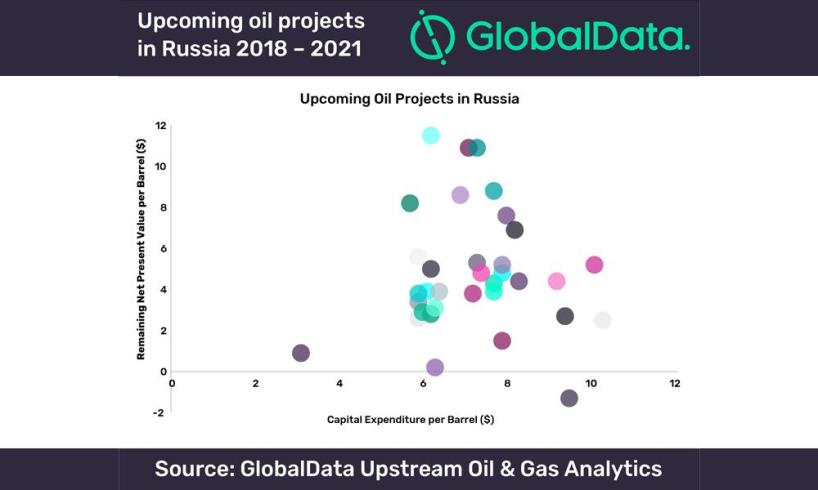

Over $79.4 billion in capital expenditure will be spent by Russia-focused operators on oil projects over the next four years, according to GlobalData leading data and analytics company. Over 16.4 billion barrels will be produced by 1,565 Russian fields over this period, with new projects contributing 636 million barrels of crude and condensate.

Anna Belova, PhD, Senior Oil & Gas analyst for GlobalData, commented: “This is to ensure that the country’s production remains at 11 million barrels per day. Russia has 34 key oil projects and 14 gas projects in the development pipeline. The contribution of new fields to the already producing oil and condensate fields, will have Russia maintaining its oil production for over four years.’’

Rosneft Oil Company will drive Russia’s oil and condensate production with over 41.3 percent share of production in 2021. Gazprom Neft and Lukoil Oil Company will follow with 15.1 percent and 14.6 percent of 2021 production, respectively.

Rosneft Oil Company will lead in greenfield oil projects, with 16 planned in the near future. Other major operators involved are Gazprom and Surgutneftegas, with six and five projects, respectively.

Belova continued: ‘‘We estimate that the average development break-even price for crude projects in Russia will be at $30 per barrel compared to conventional oil projects averaging $27 per barrel.’’

Russian heavy oil projects come online with a development break-even oil price of $70 per barrel on average, while shallow water projects require an oil price of US$57 per barrel to break even; the onshore projects have a development break-even price of US$28 per barrel. While onshore fields will produce almost 88% of Russian crude and condensate, only 2,052 million barrels of liquids coming will be from shallow water developments over the next four years.

Conventional oil fields will be responsible for 14.5 billion barrels of production, heavy oil will contribute 652 million barrels, and the remaining 1,283 million barrels will be condensate production from gas fields. Onshore fields will produce almost 88% of Russian crude and condensate, with only 2,052 million barrels of liquids coming from shallow water developments over the next four years.

Belova added: ‘‘We believe that Rosneft Oil Company will lead in greenfield oil projects, with 5 participation in 16 planned and announced projects in the near future. Other major operators involved with new oil projects in Russia are Gazprom (Gazprom Neft) and Surgutneftegas, with six and five projects, respectively.’’