Mergers and acquisitions have always been risky undertakings that can end without profit. The most complex transactions can rightfully involve M&A that can drag on for years without any visible results. In this transaction type, you and your partners must consider the merger and acquisition costs and calculate potential costs of withholding information. You need to pay attention to this before you take any meaningful business action.

The importance of effective communication in such transactions

Effective communication is important during any interaction between companies and people. If you do not understand each other’s desires and requirements, your business relationships are doomed to failure in most cases. Unfortunately, few enterprise solutions can fix the negative impact of traditional management systems, which only exacerbate user interactions for the following reasons:

- Traditional business and management practices have a hard time incorporating the role of modern technology into their everyday lives. Even when they do, they do so with inefficient, often free solutions. This only complicates user interaction and puts the data of both parties at risk of being leaked.

- For whatever reason, traditional solutions don’t look at the communication problem from different angles; they look at it from the specific use side. As a consequence of this shortsightedness, a company begins to waste money on the minimal set of features that this technology provides.

- Looking ahead, we advise you to begin your journey through the negotiation process with the help of a VDR provider (https://www.idealsvdr.com/ma-data-room/).

Communication in today’s technological sense is enhanced by well-planned resources available to the company. For example, file sharing solutions like the VDR or Boardroom portal can provide you with the following benefits when properly configured and communicated with your company:

- First, having a centralized network allows you to work in a communicative and transparent manner. Every action you take will be documented to clarify any further problems that may be identified. This increases the overall effectiveness of collaborative work and also helps to identify important issues that arise while working in collaboration with other firms.

- It also increases the transparency of the overall documentation work, which cannot go unnoticed by the users with whom you intend to collaborate. Potential investors always look first and foremost to ensure that the documentation and layout of documents are transparent and open to partners. With modern technology, you can achieve this with astonishing speed. Document indexing, as does an easy search by text or document title, comes out of the box.

The Role of Software in Simplifying Document Review

Software like VDR and Boardroom Portal, as mentioned earlier, allows you to do a lot of different manipulations with the documents you have on hand. There are quite a few advantages, and they can be summarized as follows:

- As the overall transparency of document management increases, your partners will be able to know more about the real state of affairs in your company. Reputation is immediately enhanced by the fact that you are unlikely to hide anything from them, as might be the case with traditional management. For this reason, you can observe quick due diligence and subsequent business transactions, for consistency is achieved.

- Automating tools like artificial intelligence allow you to generate additional documents based on available data and variables, reflecting the real essence of things in your company. The various departments now only need to collect the net metrics and output the result, which the file share solutions like VDR will calculate and generate. In addition, if we take Boardroom Portal technology as an example, you can communicate with your colleagues and discuss important business issues by summarizing the information that was brought up in the meetings. This does not mean that you now have no incentive not to attend discussions, but it is a handy feature in times of inability to attend such events for whatever reason.

- Proper document indexing allows you to search for the files you need in seconds, something that would be difficult to achieve with free or cheap classic solutions. Now you can search for documents by keywords right out of the box.

Utilizing software for data analysis and reporting

Data analysis has become much easier because of the availability of the enterprise solutions we discussed above. Having technology such as artificial intelligence, blockchain, and proper indexing can really do wonders for analyzing all the legal or financial information your firm has available. This technology can also be useful in generating similar documents and reports in future work.

Data analysis is an important element for most types of firms. For example, if you take law firms, since a large number of documents go through there every day, you need to analyze them properly. The virtual data room, if you take this particular technology as an example, allows you to do both a legal wrung-out of the essence and generate a report on this or that document, which was made manually.

In summary

You can take advantage of these strategies to conduct quality business transactions:

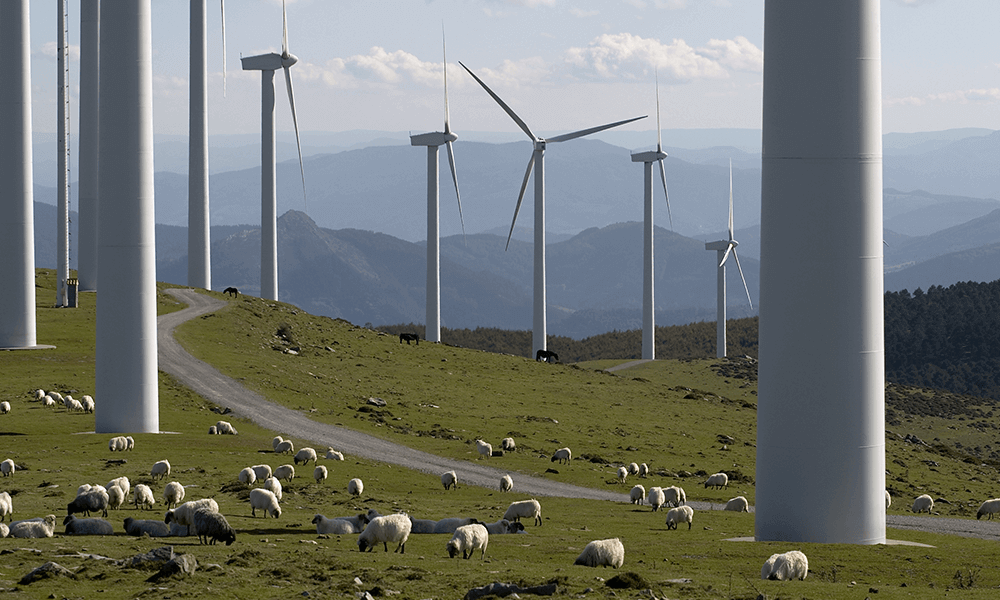

Use of VDRs. This is a classic strategy for adaptable and scalable markets that allows you to work with documentation as transparently and openly as possible, which increases the passage of the M&A due diligence process and therefore the passage of subsequent planned transactions.

Using the Boardroom portal If you want to improve your communication with your partners, you need to acquire another technology for communication called the boardroom portal. This is also a foundational tool that can greatly improve the quality of discussion on various issues and problems.

Using two technologies at once. Even though it is quite expensive, using two technologies at once will improve the perception of this deal completely. You can get through it in a matter of weeks when without these technologies, you could have spent months.With these strategies, you can count on excellent productivity.