To remortgage means that you essentially replace your existing home loan with a new one, with potentially better terms. The most popular reasons for refinancing are reducing monthly repayments, securing a lower interest rate, consolidating loans, or changing the type of loan you currently have. Before deciding whether it is a good idea to remortgage your home, first consider the following tips.

Understand Your Credit Score

Why is your credit score important? Most lenders will first check your credit score when deciding if you are eligible for refinancing, so be sure to check your score online before you do anything else. Be thorough and ensure there are no errors on your credit report. If necessary, take some time to improve your score so that you can get the best deal on your mortgage refinancing. Once you have successfully remortgaged, your credit score will likely fall, but you can quickly regain a higher score. To do so, don’t miss any repayments and don’t apply for any more credit for a while after refinancing.

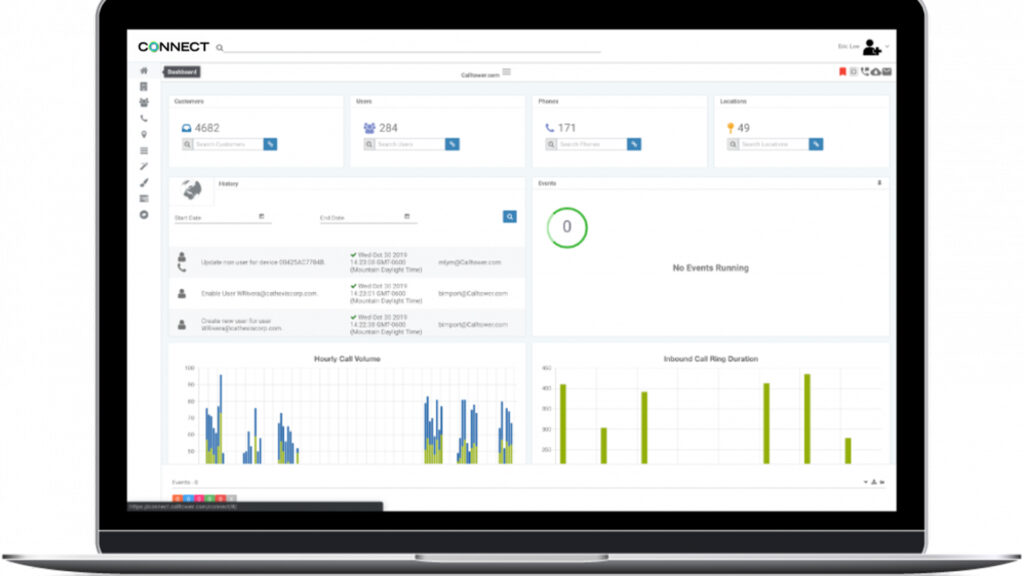

Find the Best Rate

Of course, it could be convenient to stay with your current lender, but it could save you money to consider other options and compare interest rates. You could switch from a variable-rate to a fixed-rate mortgage and get more steady monthly repayments. For example, a mortgage advisor like Trussle gives advice with an online mortgaging calculator, a remortgage guide and tutorial videos. These are fast and straightforward ways to check what your rates and deals could look like. All you need to complete the process is your property’s up-to-date value, the balance on your mortgage, your monthly repayments, and the remaining years left on your current loan. This will give you a general idea of what remortgaging will look like, but it is essential to get expert advice and discuss your personal circumstances.

Look at the Big Picture

Don’t solely focus on interest rates when considering a remortgage. You should also take into consideration what your long-term objectives are and how long you want to live in your house. The goal of refinancing your home is most likely to save money and anything that saves you money usually means shopping around. Don’t just go with the first rate you are offered, consider what the fees for refinancing will be and add this into your final calculations. What may initially appear to be a good deal could end up costing you more if the fees for remortgaging are high. If you remortgage to reduce monthly repayments, you will most likely also extend the length of your loan. So, consider the potential long-term downsides of extending.

Nowadays, it is common for homeowners to remortgage at some point during the term of their loan. If you are on a fixed deal, it’s advisable to start shopping around six months before the end of your loan term. However, it could also be beneficial to remortgage sooner.