3 Ways To Properly Monitor Your Small Business Books

Good bookkeeping skills are the foundation of any successful business. However, due to their overloaded schedule, many small business owners put off bookkeeping and accounting for as much as they can.

However, this can create a series of problems for the business, since it’s easy to miss a deadline or forget about a contract.

Not to mention that when you keep your books balanced, it’s easier to understand your cash flow and even create a financial forecast for the future. Plus, when you have accounting insight, you may even have the skills to deal with financial difficulties.

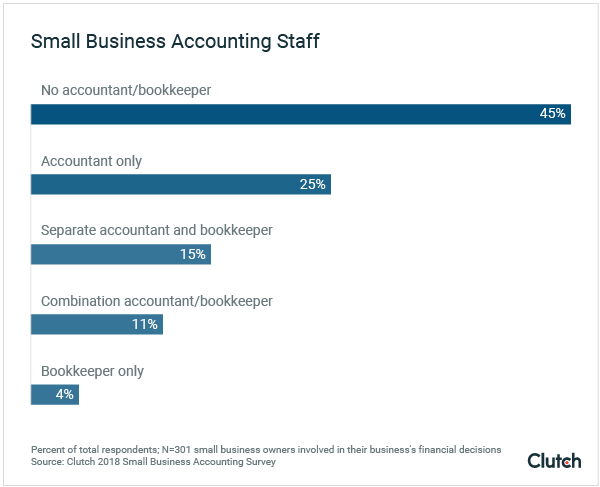

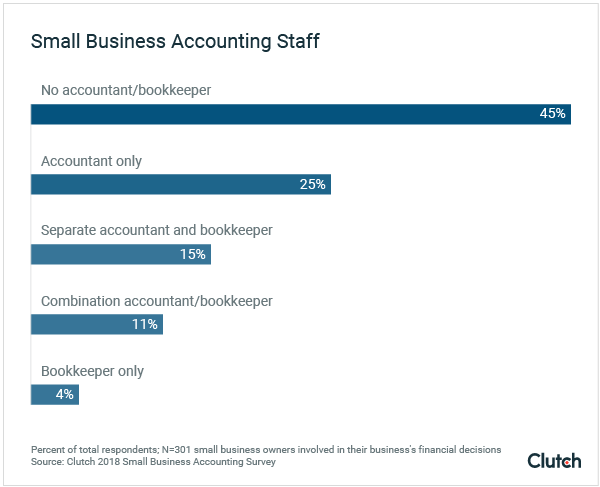

Yet, it’s easy to see why small business owners put off bookkeeping. After all, it’s not the most exciting part of being an entrepreneur. Yet, according to a recent study, 45% of small businesses don’t employ an accountant or a bookkeeper.

So does this mean most business owners have their bookkeeping game up to date and don’t need help from a specialist? Sadly, in most cases, it just means the owner is trying to save money without having the right skills.

However, it’s important to understand that, when accounting mistakes occur, it could cost your business a lot more than what you saved by not hiring a specialist.

However, as long as you have the skills it is not impossible to do your own accounting. If you’re going down that path, here are a few tips to help you stay away from trouble.

#1: Make Technology Your Friend

With so many apps and platforms designed to help entrepreneurs keep track of their expenses, receipts, and income, no one should be keeping their books in a worksheet! Yet, there are many small business owners who find this method cheaper and more comfortable.

If you are one of those business owners, it’s time to step it up a notch and find an app that works for you. It will make it easier to track your expenses, create invoices, and most of them even generate little reports highlighting your patterns.

#2: Do Talk To a Specialist

Accountants and finance specialists have a different view of the business world and it helps to get their input from time to time. However, make sure you get someone reliable, who understands your niche and situations.

For instance, if you want to consult a finance specialist (or a CPA), make sure to choose someone who successfully took top CPA courses. This way, you know you are meeting someone with the right skills for the job.

#3: Keep Personal and Business Apart

You would be surprised to know just how many beginner entrepreneurs don’t follow this rule! While it is not against the law to use your personal account for business needs, it turns accurate bookkeeping into a nightmare.

Many small business owners will find themselves using personal money to keep the lights on, but once things get on the road, it’s important to have separate accounts. This way, you can keep track of every transaction, and you’ll know where the money goes and where they come from.

Wrap up

Clean books and good accounting practices are also helpful when it comes to tax time. When you have everything neatly charted and organized, it’s easy to fill in those forms and move on with your day.

Plus, when your finances are in order, you have the time and drive to look after other aspects of the business such as cost-efficient ways to strengthen your brand or online marketing campaigns. Overall, the financial aspect of a business should not ever be left in the second place!