Mergers and acquisitions can drive remarkable growth, but they’re sometimes challenging to understand. Getting expert help from a qualified, knowledgeable advisor is crucial if you hope to maximise your returns and avoid complicated tax and legal issues. So, what are the top-rated advisory services for mergers and acquisitions?

The best advisory firm depends on your specific market, goals and needs. Still, a few industry leaders stand above the rest as options that demand your attention first. Here are five of the best M&A advisory services to consider.

1. BDO

The best overall M&A advisor is BDO, a global tax and advisory firm with over 70 locations and 12,000 professionals ready to help. BDO has repeatedly received recognition and awards as a top-10 accounting service, and its people-first but tech-centric approach to audits and advice makes it a reliable partner in today’s market.

BDO’s M&A services cover the entire pipeline, from due diligence to guiding implementation and de-risking after the deal. It also emphasises understanding and meeting buyers’ and sellers’ unique needs instead of applying a one-size-fits-all approach. The company has a strong track record of regulatory compliance, tax performance and tech adoption, which help it provide comprehensive aid in complex modern environments.

2. Bain & Company

Boston-based Bain & Company is another top-rated M&A advisory service, especially for private equity deals. The company specialises in larger deals but has experience across industries and locations, making it adaptable.

Like BDO, Bain offers a suite of services to guide you from planning to post-merger integration. It also claims to drive 18% more value after a deal than companies that don’t use its expertise, and such a track record is hard to ignore. The company has even developed a program management tool to maximise transparency and streamline operations in a merger, which is particularly helpful for highly regulated sectors like health care.

3. Deloitte

As one of the “Big Four” accounting firms, Deloitte also commands attention as an M&A advisor. It’s the largest accounting provider in the U.S. by revenue, and while size does not automatically make it the most beneficial service, it signifies a reputation built on providing genuine value.

Deloitte emphasises region-specific regulatory compliance, which it can account for thanks to its massive geographic footprint. It also offers restructuring advice if you need help optimising your organisational structure after a deal. Smaller companies may get less out of it than those involved in larger M&A activity, but its sheer range of expertise and product offerings make it a leading option.

4. McKinsey & Company

Another familiar name for many, McKinsey & Company is one of the top-rated advisory services for tech-centric M&As. McKinsey does not report many specifics on the deals it has completed, but its excellent reputation and emphasis on data-driven decision-making may make up for the lack of transparency.

The strategic advisory firm has created multiple digital tools to help in research, planning and post-merger integration. This focus on technology and data is most advantageous in complicated deals or those in tightly regulated industries.

5. Kearney

A fifth option to consider is Kearney, whose founder was an original partner of McKinsey. Today, Kearney is a smaller but well-respected player in the management consulting space. Despite its size, it has worked with most of the Fortune Global 500, giving it extensive experience across industries and with high-value deals.

Kearney begins its M&A services by working to understand your needs and goals. This approach can make it easier to ensure you get the outcomes you want, even if the following process may depart from conventional wisdom. Organisations with niche considerations will benefit the most from the method.

How to Choose an M&A Advisory Service

Any of these five firms would make an excellent mergers and acquisitions partner. Ultimately, your choice depends on a few case-specific factors.

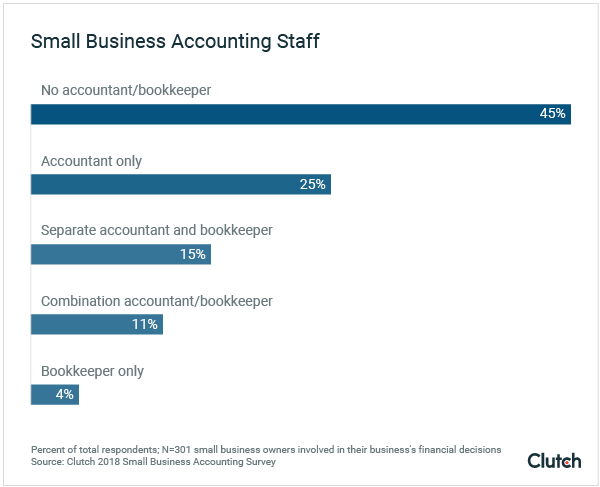

Industry experience is a crucial characteristic. Up to 90% of M&A deals fail, often due to a lack of expertise or failure to dedicate enough resources to the merger. Knowing more about the sector and having the tools necessary to account for its unique obstacles makes a considerable difference in your M&A’s success, so you want to partner with a firm with a proven track record in your industry.

Similarly, you should consider an advisor’s experience with companies of your size. Services that account for specific goals or needs — such as environmental and social targets or regulatory compliance concerns — are equally essential. Any service that can’t provide such support or lacks a history in these areas may not be worth the investment.

The best M&A advisory services are honest about these factors. However, you can also read reviews and research the organisation to find additional details on its history with businesses like yours to learn if they’re a reliable partner.

Partner With a Top-Rated Advisory Service Today

Research, planning and careful execution are essential to M&A deals. Ensure success by partnering with a top-rated advisory firm. Begin your search with this brief list, narrowing down your unique goals to find an advisory firm that works for your business and sector.