FP Transitions is a specialized business consulting firm dedicated to wealth managers and independent financial advisors with over twenty years of industry expertise. Recently accredited as Oregon’s Best Wealth Management Consulting Firm, 2022, FP Transitions offers a full-service concierge approach to supporting advisors during critical points within their business life cycle.

Established in 1999, FP Transitions offers a comprehensive, coordinated approach to wealth management consulting whilst customizing solutions to each client, achieving, and exceeding long-term sustainable business growth.

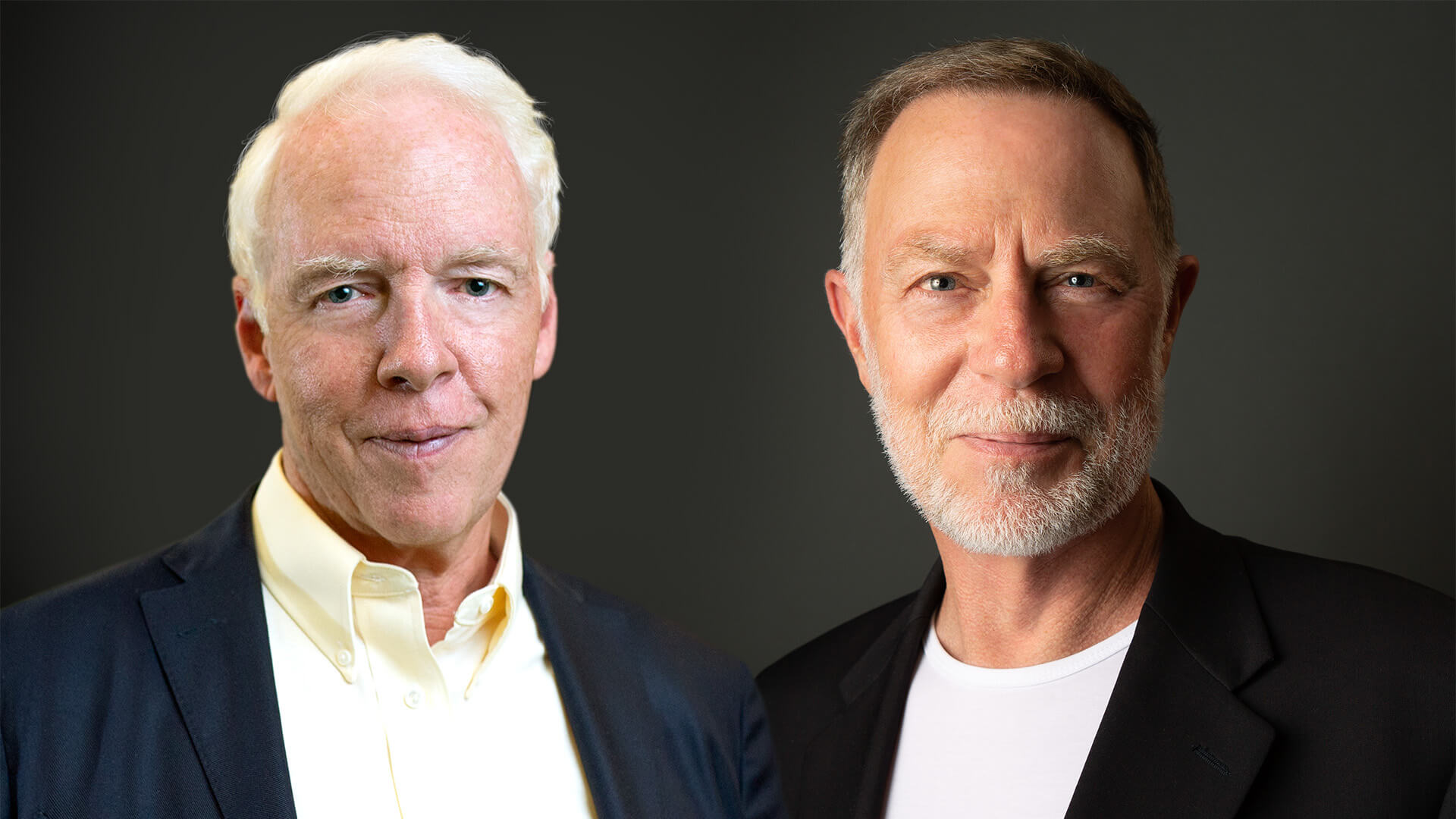

Headed by CEO Brad Bueermann, the company has experienced exponential growth during his leadership. With the impressive industry achievement of personally supervising consulting assignments with some of the country’s largest broker-dealers, custodians, and insurance companies, Brad together with Founder David Grau, Sr, JD continues to lead the next generation of strategies for independent wealth management firms.

Brad’s innovative thinking and revolutionary work around building enterprise value and creating sustainable wealth management firms has solidified the FP Transitions name as a leader for the industry.

Based in Lake Oswego, Oregon, FP Transitions is built of nearly 60 individualized experts who have grown to specialize in various sectors whilst operating the largest open market for buying and selling financial practices. “We help manage the enterprise value our clients have built over their lifetime in this industry. In addition we work to build enduring firms to ensure the firm provides services to their clients well beyond their need horizon,” states Brad.

FP Transitions has led the industry with its decade-long expertise and experience within the wealth management sector. With that, its core services have been noted to provide sheer excellence in standards and quality customer care.

FP Transitions has a full-service team of licensed and credentialed lawyers, Chartered Financial Analysts (CFA), Certified Valuation Analysts (CVA), Certified Business Appraisers (CBA) and Certified Financial Planners (CFP) who oversee mergers and acquisitions, enterprise development, transaction support, synthetic equity, succession planning, business valuation, compensation structuring and growth strategies. The company also offers business and enterprise coaching through its proprietary Equity Management SolutionsTM – a membership program built upon real data points from independent advisory firms to help advisors value, protect, and grow their businesses.

Specializing in the valuation and analysis of the intangibles that make each financial services practice unique and valuable, FP Transitions has been able to complete more advisory M&A transactions than any other investment banker or business broker in the country. With more than 14,500 business valuations completed since its establishment, FP Transitions is proud and honoured to have helped thousands of advisors build and grow sustainable enterprises.

“We employ strategies that build upon a lifetime of work and trusted client relationships and execute a plan for succession designed to simultaneously realize value for the founder and perpetuate the business for the next generation of advisors,” states FP Transitions’ President and Founder, David Grau, Sr, JD.

FP Transitions’ planning process includes expert guidance in areas such as practice valuation, benchmarking, equity management, setting up equity-centric organizational structures, restructuring ownership-level compensation structures to support internal ownership tracks, and the development and design of customized plans centred on sustainable enterprises.

Moreover, the company can assist in creating or modifying entity structures to work for multiple generations of owners and cash flow modelling a variety of continuity and Success in Succession Planning™ solutions.

“This kind of work takes a talented group of people who aren’t afraid to pioneer the concepts needed to help our clients succeed and to evolve time-honoured approaches to meet the demands of a new century of rules, regulations, and taxes,” explains David.

While FP Transitions is notable for working directly with independent financial advisors, the company is also heavily invested in sectors relating to broker-dealers, custodians, and insurance providers. Thus, developing and implementing business transition systems and procedures for field usage.

By incorporating these two categories of work, FP Transitions has built a powerhouse team of experts in all facets of the wealth management space. One of its core values is a non-advocate approach to the M&A process, meaning all parties are equally evaluated for deal ‘fitness’ and ensure viability and best interests are satisfied for all sides of the deal.

Compared to other businesses within the industry, FP Transitions is considered highly unique with its genius foresight predicting and solving for the industry’s biggest challenges. In the past year, the firm has boosted its bench strength with industry leaders that share an impassioned vision for the future of the firm, and its vital role in the sustainability of this industry, particularly for independent financial advisors. “We believe the future of wealth management depends on independent advisors optimizing their firms by attracting next generation talent, evolving their compensation structures, and operating profitable, dynamic businesses that focus on driving value for the end investor,” shares Brad.

At FP Transitions, its internal culture keeps the company compassionate about the industry and the clients they work with and directly relates to its national success. “Our culture is incredible, and it is one of the reasons we continue to attract and retain top talent across this industry. We practice what we preach to our clients – a living example of the work we do for others,” states Christine Sjölin, Partner and Vice President of Strategy and Operations.

With FP Transitions buckling in for the storm, and due to its incredibly dynamic and reassuring company culture, its team of highly dedicated and creative individuals were able to react quickly to the pandemic. As a result, while there was a quiet turn in the early side of 2020, by mid-May, the company was in full effect and ready to continue its efforts to build and fortify tomorrow’s advisors.

Brad discusses the increasing issue of this factor by stating, “Advisory firms, especially independent firms, should be built to serve the entire client need horizon, while many aren’t. The problem likely stems from the fact that advisors have acquired clients and are most often charging by AUM (Assets under management), which causes a higher minimum ($100,000+ in assets). So, by the time a client has enough wealth to seek out an advisor, they seek someone roughly the same age, and then suddenly we have a high risk of this advisor potentially retiring at the same time as their clients.” Retirement is one of the most significant moments for a financial planning client’s advisor relationship. Therefore, FP Transitions’ consulting work focuses heavily on engaging the right junior talent to transition the ownership and management of the firm thereby ensuring clients will be cared for when founding members or owners turn the establishment over to a new generation.

FP Transitions is confronting this issue by aiding firms in spreading out their equity within practices, as well as encouraging advisors to seek someone with the right skills for the role. For example, an owner may need to recruit three or more junior partners, buying into the firm over several years, in order to ensure the firm has a sustainable future.

FP Transitions is also engaged in research and programs intended to solve many of the overarching issues found across the financial planning and wealth management landscapes. The company has captured essential data points on businesses and has formed a Business Intelligence team to constantly measure and monitor the catalysts for growth and transition, evolution, and sustainability across this vast network of independent advisory practices.

Moreover, FP Transitions is heavily invested in leading the ‘talent revolution,’ which involves revamping compensation structures, spreading equity within entities, ownership training, and many other aspects that the company firmly believes the industry needs to build enduring and sustainable businesses.

For business enquiries, contact Jess Flynn, Director of Communications from FP Transitions via email – [email protected] or on their website – https://www.fptransitions.com/