In a post-covid world, mainstream banks and lenders have highlighted a much stricter lending criteria for mortgages, with first-time buyers to be hit the hardest.

A long period of uncertainty awaits, with banks reluctant to lend to borrowers when employment and furlough schemes mean unpredictable incomes for many.

Those unable to get a mortgage may look at other alternatives, with renting expecting to see huge growth or people seeking alternatives such as bridging finance to close on a specific deal.

Bridging finance or bridge finance is often used by property developers and homeowners looking to complete on a property within a tight deadline. It has been hugely adopted by those buying properties at an auction and need to complete quickly, without needing to go through the long mortgage process. For property developers, they use this form of specialist finance to avoid property chains and complete on deals quickly, rather than potentially losing them to a rival bidder.

You will always have to use some kind of property as security, whether it is your existing property or the property you are looking to purchase, so there are risks if you do not repay on time.

Dan Kettle of Octagon Capital commented: “Covid or not, people still need to move house or property in these uncertain times. Whether you are having children and need a bigger place or downsizing because you no longer need the space – or even want to move further out to the countryside, which is something that we are seeing more of now. Either way, people are always going to be moving in their lives and this means they need mortgages or something similar.”

“Bridging finance can provide a very effective form of finance if you have a property in mind and do not want to risk losing it, but have not sold your original one. You can borrow for up to 24 months and simply repay when you have completed the sale of your own property.”

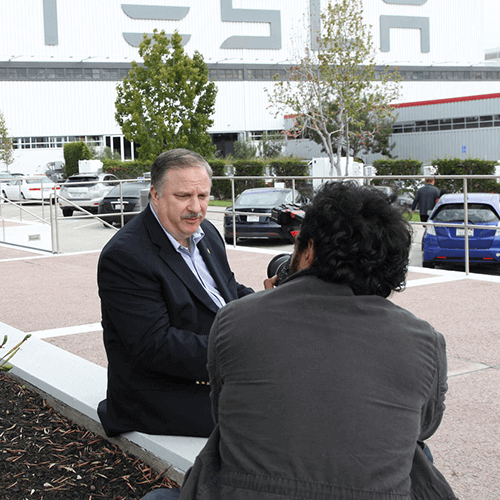

Matt Sullivan of Kramer Sullivan responded: “Bridging is effective and popular means of finance and it emerged initially following the economic crash in 2008 – so it is not surprising that it will be popular in these difficult times.”

“As a law firm, we seen a lot of deals that go well and also go sour. So we always advise bridging if there is a clear exit plan, or you could be risking the potential repossession of your property.” “It is important to shop around with bridging lenders and check rates beforehand. Be wary of early exit fees and other clauses, since these can add up.”