Anthony Ginsberg, Co-creator of the HAN-GINs Tech Megatrend Equal Weight UCITS ETF (ITEK) says the huge increase in expenditure on products and services from innovative technology sectors during the Coronavirus crisis could rise dramatically as restrictions lift and societies and economies begin to return to some form of normality. This is because businesses, hospitals and consumers are unlikely to go back to pre-COVID-19 habits, and growing societal, economic and environmental pressures force change.

The HAN-GINS Tech Megatrend Equal Weight UCITS ETF (ITEK), formerly known as the HAN-GINS Innovative Technologies ETF, is a UCITS compliant Exchange Traded Fund listed on the LSE, XETRA, SIX and Borsa Italiana, and tracks the Solactive Innovative Technologies Index (Net Total Return). This consists of leading companies that are driving innovation in sectors including Robotics & Automation, Cloud Computing & Big Data, Cyber Security, Future Cars, Genomics, Social Media, Blockchain and Augmented & Virtual Reality.

In June 2020, the ITEK ETF recorded an impressive gain of 6.70%. Over the past 12 months, it has gained 23.5% and its NAV has recently hit an all-time high of $10.21/share. (1)

Past performance is no guarantee of future performance. When you invest in ETFs your capital is at risk.

ITEK’s Anthony Ginsberg said: “COVID-19 lockdowns and the search for a vaccine have helped boost adoption rates across a variety of innovative technologies. Behaviours are changing fast – businesses, hospitals and consumers will not return to many of their habits pre COVID-19.

The increasing shift to the cloud has also led to a sizable increase in demand for cybersecurity companies. Several of our holdings benefited from the growth in VPN and other forms of security software licenses.

“The strong tailwinds propelling the cloud market alongside its critical infrastructure-like role in the modern digital economy has created a great deal of investor interest in the sector. Spending on cloud already accounts for a large proportion of corporate IT budgets and this is expected to continue to increase.”

Electric and hybrid vehicle market

Ginsberg says the investment opportunity of the electric and hybrid vehicle market is well illustrated by the fact that, by market cap, Tesla is the now the largest car company in the world. (2) However, he points out that electric and hybrid vehicles still represent only a small portion of the overall automotive market – about 2.7% of all sales in 2020. Nonetheless, growth is significant, with sales surging from 450,000 vehicles in 2015 to 2.1 million in 2019. (3)

“This growth trajectory is expected to continue with as many as 54 million vehicles, or 58% of the total market being electric or hybrid in the next 20 years.” (3)

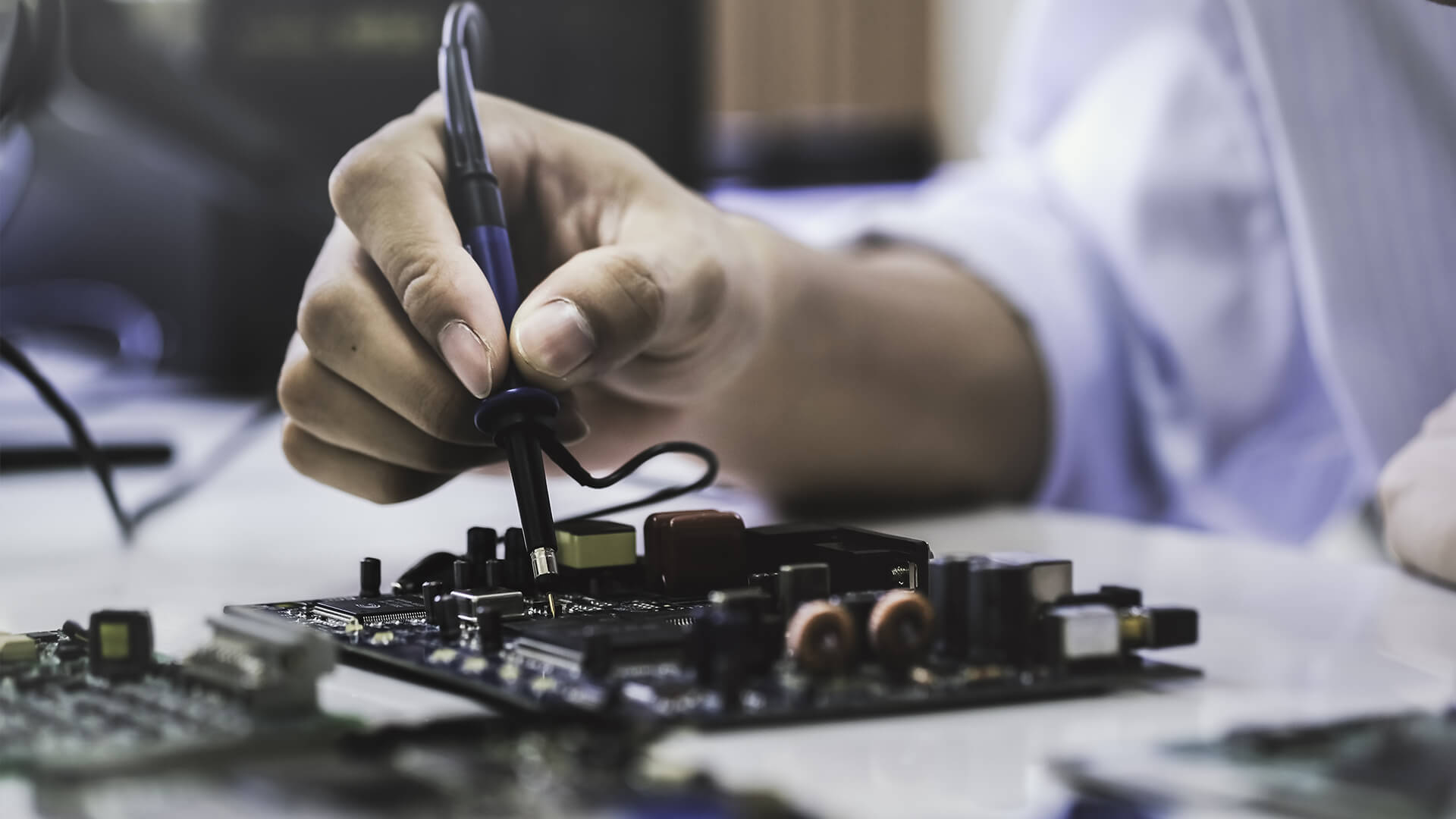

Robotics and AI

Robotics and AI are addressing a host of problems resulting from an aging population, rising labour costs, and quality improvement needs.

Other factors such as the US/China trade war is also likely to see a rise in demand for robots. This is because it should lead to the onshoring of more US manufacturing post COVID-19, and this is likely to boost demand for robots given their cost savings versus US workers.

Anthony Ginsberg said: “Labour costs are expensive and rising, which is a particularly challenging prospect for competitive industries like manufacturing. While offshoring helps, many companies are finding robots to be even more cost efficient.

“Production output is increasing dramatically as robots become cheaper to produce. The cost of industrial robotics is expected to drop to average levels of just $20K per robot – converging with the cost of an average manufacturing worker.

“As the economic case for robotic workers becomes more attractive, the industry is expected to grow 10% p.a. hitting $83bn in 2020.” (4)

Genomics market

Anthony Ginsberg says the Genomics market is expected to be a high-growth healthcare theme. In 2019 the market was estimated to be worth $19 Billion and it is expected to grow to $39.7 Billion by 2024 – a CAGR of approximately 13.5%. (5) Genome-based research is already enabling medical researchers to develop improved diagnostics, more effective therapeutic strategies, evidence-based approaches for demonstrating clinical efficacy, and better decision-making tools for patients and providers.

Social media

While most traditional advertising mediums have been in long-term secular decline, GinsGlobal Investment Management says digital advertising spend has rapidly accelerated.

Anthony Ginsberg said: “In 2016 the ad industry became digital-first, with more advertising dollars spent online than on TV, or any other form of media. In total, online ad spending grew from ~$48.4bn in 2008 to ~$227bn in 2018 and is estimated to reach $274bn this year. Social media is increasingly dominant in the digital advertising market.”