If you’re struggling to keep up with multiple monthly payments from a list of cash advance apps, debt consolidation may be a good option for you. This process involves combining all of your outstanding debts into a single balance that has a lower interest rate.

You then make just one monthly payment to the debt consolidation company. This can help you save money on interest and get out of debt faster. In this blog post, we’ll discuss the benefits of debt consolidation, the different options available, and how to get started.

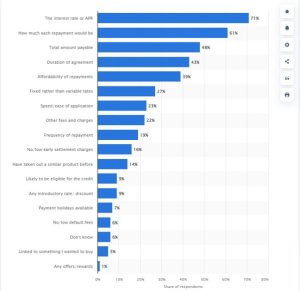

A personal loan can provide a much-needed financial boost when used wisely. But with so many potential uses for a personal loan, it can be tough to decide whether or not one is right for you. A recent study by Bankrate may help to clear things up.

According to the study, which surveyed more than 160,000 applicants, debt consolidation was the most reported reason for getting a personal loan in quarter one, at 38%. An additional 5% of applicants selected credit card refinancing as their main motivation.

While these two reasons were the most popular among respondents, they were far from the only ones. Other popular reasons for taking out a personal loan included home improvement (11%), medical expenses (9%), and major purchases (8%). So, if you’re considering a personal loan, you’re far from alone—and you’re certainly not limited in how you can use the money.

What Is Debt Consolidation?

Debt consolidation is the process of combining multiple debts into one loan with a lower interest rate. This can help you save money on interest and get out of debt faster. There are several different ways to consolidate debt, including balance transfers, personal loans, and home equity loans.

Balance transfer: A balance transfer is when you move the balance of one debt to another account with a lower interest rate. For example, you could transfer the balance of your credit card to a new card with a 0% introductory APR.

Personal loan: A personal loan is when you borrow a fixed amount of money and repay it over a set period of time, typically two to five years. Personal loans typically have fixed interest rates, which means your monthly payment will stay the same for the life of the loan.

Home equity loan: A home equity loan is when you borrow against the value of your home. Home equity loans usually have lower interest rates than other types of loans, but they do come with the risk of losing your home if you can’t make the payments.

How to Consolidate Debt

If you’re ready to consolidate your debt, there are a few things you need to do:

-Figure out how much debt you have: Make a list of all your debts, including the amount owed, interest rate, and monthly payment. This will help you know how much debt you have and where to start.

-Compare interest rates: Once you know how much debt you have, compare the interest rates of each debt. This will help you decide which debts to consolidate.

-Choose a consolidation method: Choose the consolidation method that makes the most sense for your situation. If you have good credit, a personal loan may be the best option. If you have a lot of debt with high-interest rates, a balance transfer may be the best option.

-Apply for consolidation: Once you’ve chosen a consolidation method, it’s time to apply. You can do this online or in person.

-Start making payments: Once you’ve been approved for consolidation, start making your monthly payments. This will help you get out of debt faster and save money on interest.

The Benefits of Debt Consolidation

There are several benefits of consolidating your debt, including:

-Lower interest rates: When you consolidate your debt, you may be able to get a lower interest rate. This can help you save money on interest and get out of debt faster.

-One monthly payment: When you consolidate your debt, you’ll have one monthly payment instead of multiple payments. This can make it easier to stay on top of your payments and get out of debt.

-Pay off debt faster: When you consolidate your debt, you may be able to get a shorter repayment term. This can help you get out of debt faster and save money on interest.

-Improve your credit score: When you consolidate your debt, you may be able to improve your credit score. This can make it easier to get approved for loans in the future.

The Consequences of Not Consolidating Your Debts

If you don’t consolidate your debts, you may:

-Miss payments: If you have multiple debts, it can be easy to miss a payment. This can damage your credit score and make it harder to get out of debt.

-Pay more interest: If you have high-interest rates on your debts, you may end up paying more interest over time. This can make it harder to get out of debt and may cost you more money in the long run.

-Damage your credit score: If you miss payments or have high-interest rates on your debts, it can damage your credit score. This can make it harder to get approved for loans in the future.

-Stress: If you have a lot of debt, it can be stressful. This stress can affect your mental and physical health. Consolidating your debt can help reduce this stress.

In Conclusion

There are several options for consolidating your debt, and each has its own benefits and risks. Choose the option that makes the most sense for your situation and start working towards getting out of debt.

If you’re struggling with high-interest rates, monthly payments, and the stress of multiple debts, consolidation may be a good option for you. Consolidate your debt with one of these methods: personal loan, balance transfer, or home equity loan. Each method has its own benefits and risks, so choose the one that makes the most sense for your situation. Start working towards getting out of debt and improving your financial situation today.