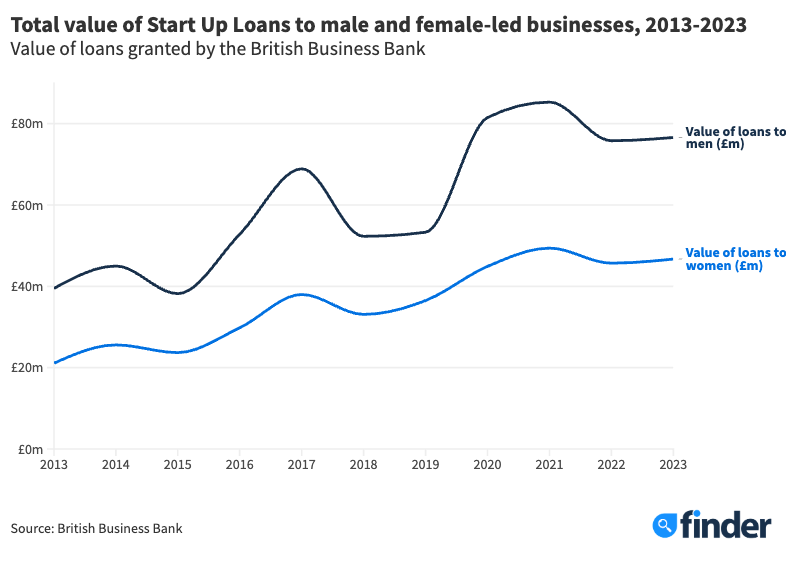

- The value of Start Up Loans to female entrepreneurs in 2023 was almost £30 million lower than the figure for male entrepreneurs.

- The startup financing gap has widened by £13 million since 2019, when the Rose Review recommended funding to female entrepreneurs should increase.

- The proportion of Start Up Loans granted to women has also dropped since 2019, but representation of women on FTSE 100 boards has increased by 10 percentage points.

The financing gap between men and women for government-backed Start Up Loans has widened by 78% since the Alison Rose Review was published in 2019 – an independent review of female entrepreneurship in the UK commissioned by the Treasury.

The gap in the value of loans to male vs female entrepreneurs is now £13 million wider compared to 2019, according to new research by personal finance comparison site finder.com.

This is despite one of the key recommendations of the Rose Review being that funding to female entrepreneurs should increase. The report highlighted that up to £250 billion of new value could be added to the UK economy if women started and scaled new businesses at the same rate as men.

Following the findings, the government announced an ambition to significantly increase the number of female entrepreneurs by 2030. However, analysis of data exclusively obtained from the British Business Bank found the value of Start Up Loans granted to female-led businesses in 2023 was £46.7 million, while the value of loans to male-led firms was £76.6 million, creating a gender disparity of £29.9 million.

On paper, the value of loans granted to female entrepreneurs has increased since 2019, but it has not risen at the same rate as loans to men. The value of loans to male-led businesses increased by 44% in this period, rising from £53.3 million to £76.6 million, compared to an increase of just 28% for female-led businesses, rising from £36.5 million to £46.7 million.

The proportion of loans granted to female entrepreneurs has fallen since the Rose Review

As well as looking at total loan value, the analysis also reviewed the number of individual loans granted to men and women and found that only 2 in 5 Start Up Loans were granted to female-led businesses in 2023.

While the actual number of Start Up Loans granted to women has increased slightly, from 3,557 in 2019 to 3,850 in 2023, the percentage of loans granted to women has decreased from 43% in 2019 to 40% in 2023. This is despite the government’s target of boosting female entrepreneurship in the UK.

Olenka Kacperczyk, Professor of Strategy and Entrepreneurship at the London Business School, explains how bias among lenders can impact women entrepreneurs:

“Investors and lenders systematically discount and overlook the potential of women founders to deliver returns. These biases persist even in carefully controlled experimental settings, as women founders receive less favourable evaluations and resource commitments than men when presenting the exact same startup pitch and credentials.”

But there are more women on FTSE 100 boards

Over the same period, there has been a rise in women holding leadership positions at the UK’s largest companies. 42.6% of members on FTSE 100 boards were women in 2023, up from 32.4% in 2019.

This suggests that progress towards gender parity is being made among the big hitters in the UK, while funding for new businesses in the form of Start Up Loans is still lagging behind, despite the recommendations in the Rose Review.

Commenting on the findings, Michelle Stevens, business loans expert at the personal finance comparison site finder.com, said:

“Work is being done to improve representation at the highest level, as shown by the make-up of FTSE 100 boards, so why can’t the same be said for those wanting to launch or grow a small business in the UK?

“I’d like to see funding for female-led startups growing at the same rate as for male-led startups. SMEs are the backbone of the UK economy, making up 99.9% of private sector companies and contributing 53% of turnover. Therefore, real progress requires funding support for female founders early on in their entrepreneurship journey, so they can help shape the future business landscape.”

The research was conducted alongside a white paper investigating access to funding for female entrepreneurs in the UK, featuring analysis from a range of experts.

To see the white paper in full, visit: https://www.finder.com/uk/business-loans#smereport

About Start Up Loans:

Start Up Loans are government-backed personal loans available to aspiring entrepreneurs looking to start or grow a business in the UK. They are granted by the British Business Bank, a government-owned but independently managed business development bank.

Methodology and sources:

Finder analysed data obtained from the British Business Bank on the number and value of Start Up Loans granted to male and female entrepreneurs from 2013 to 2023. Data on the percentage of women on FTSE 100 boards was taken from the FTSE Women Leaders reports. Data on SME contributions is taken from GOV UK business population estimates.