“Paper money is going away,” says Elon Musk.

When the person who is lending rockets to NASA says something about the future of technology, the world pays attention. The billionaire also walked the talk instead of just preaching. His company invested over $1.5 billion in Bitcoin this year.

The future of blockchain looks promising and businesses, especially online-only businesses, are beginning to accept cryptocurrencies as a form of payment. As adaptability grows, cryptocurrencies will likely see appreciation in value as a result of an increase in demand.

However, there are some challenges, at least for the time being. Cryptocurrencies tend to be extremely volatile. It’s not uncommon for investors to shed 50% of the investment value in a week or gain 200% returns in a month.

That said, cryptocurrency investors are quickly growing in numbers. Many are also witnessing their weak side giving in to the FOMO. However, there are a few caveats to investing in cryptocurrencies.

Is Investing in Cryptocurrency a Wise Idea?

It depends on the investor’s risk appetite and time horizon, among other things.

Cryptocurrencies have provided attractive returns to many investors over the past half a decade. However, the high returns come with a significantly high risk as well.

Investors should only invest money that they can lose in cryptocurrencies. Investing money that the investor may need anytime soon is a disastrous proposition. The reason is that crypto prices can swing massively, and exiting liquidating the investment could possibly come with capital erosion if done in a haste.

To that point, it’s also true that investors that take a prudent approach can generate considerable returns from investing in cryptocurrencies. Let’s talk about why investing in cryptocurrencies could be a fruitful endeavor for an investor.

Greater Return Potential

Cryptocurrencies can potentially offer greater returns than any other asset class. The returns, of course, come with higher risk as well. Cryptocurrencies are volatile. Period. There’s no getting around it.

However, investors that have trading experience know that volatility can also work in their favor, as long as they know when to enter and exit a position. Plus, they don’t limit themselves to a single coin either.

Consider being a crypto investor that has cash loaded ready to deploy. They’re looking for an opportunity. In July, most coins shed almost half the market cap. While this caused many investors to lose sleep, experienced traders look at this as an opportunity.

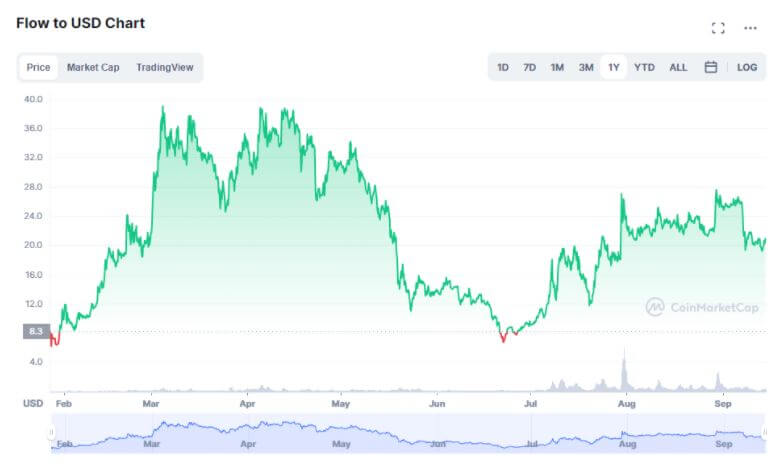

Say an investor wanted to buy flow when the price bottomed out in July, even though everybody said that’s a risky bet. This is what their investment returns would have looked like:

That’s over 200% return in less than 2 months. Impressive, correct?

That’s not to say that this wasn’t a risky bet. However, experience can help investors gauge the market sentiment and enter at the right time. When the strategy plays out favorably, investors walk out with a lot more money than they put in.

Quick Adoption and Accessibility

Even with the associated risks, businesses are quickly beginning to accept cryptocurrencies as a valid form of payment. The financial infrastructure is beginning to strengthen and retail investors are starting to invest actively in cryptocurrencies too. Plus, small investors also have accessibility to more tools that they need to safely invest in cryptocurrencies.

Giant companies such as PayPal are now making it easier for investors to buy and sell cryptocurrencies. Institutions aren’t just facilitating crypto transactions though. Large corporations like Square and Tesla have invested billions of dollars in Bitcoin.

Granted that these factors don’t reduce the associated risk, but these certainly imply that blockchain technology is beginning to mature. Institutional as well as retail investors are beginning to show interest in taking direct exposure to crypto coins, and some are even investing a considerable amount.

Lower Empirical Probability of Loss Over the Long Term

Believers of blockchain technology that are prepared to ride out the storm and stay invested over the long term have an edge over short-term investors. There are several ways to reduce risk in any investment, and a longer time horizon is one of them.

Investors typically diversify their holdings across market caps and value propositions when it comes to reducing the risk associated with investing in cryptocurrencies. Staying invested for the long term, much like diversification, helps reduce the risk.

Let’s look at some data to back this claim. Look at the price of any fundamentally strong crypto coin. Most will have appreciated in value over the long term. Following are the prices for the two most popular crypto coins:

- Bitcoin: Price chart from August 2013 to September 2021

- Ethereum: Price chart from August 2014 to September 2021

Those returns are probably going to pop some eyes out, but it’s important to realize that these massive returns also come with a lot of risks. Nevertheless, investors that stay invested for the long term are probabilistically going to come out with a healthy profit.

Availability of Low-Risk Alternatives

There is a group of investors that vows not to take on excessive risk. This is a quality that often saves investors a lot of pain. Investors must always identify the level of risk they can tolerate before investing their money. Taking on excess risk is a sure-fire way to lose sleep.

This shouldn’t mean that investors with low risk tolerance can’t gain exposure to the crypto space. Thanks to stablecoins, investors that want to invest money in crypto and preserve their money’s value have options.

Stablecoins are to the crypto-verse what T-bills are to the traditional asset classes. They offer a low-risk alternative to their risky counterparts (altcoins) for investors that want to gain some crypto exposure.

There’s just one caveat, though. Stablecoins don’t generate any capital gains because their price is pegged to another asset, typically a fiat currency. For instance, investors that buy USDC are essentially buying digital dollars. The price of USDC is pegged to the U.S. Dollar and tends to hover in a tight range around $1.

Fortunately, there is another way to generate returns from stablecoins. Think about it, they are what T-bills are to traditional investments… ring a bell?

Well, stablecoins can generate a fixed income for investors when deposited with a platform like Nexo that offers as much as 12% returns. 12% is still more than most asset classes can return in the U.S. The 12% return, again, carries risk — high returns are always a form of compensation for higher risk.

The first risk is that the platform can change the offered rate at any time at their discretion. The uncertainty about the returns poses a challenge during financial planning. Plus, unlike bank deposits, money deposited with such platforms isn’t protected by FDIC or SIPC. If the platform goes bust, there’s no way to recover the money.

Even with those risks, an investor with a relatively low appetite for risk could invest a small portion of the portfolio to stablecoins. 12% is nothing to sneeze at, after all.

Cost-Effective for Overseas Payments

Though the fees differ among blockchain networks, most are relatively more cost-effective than making payments through a bank. Transferring payments via bank generally comes with “maker” and “taker fees, deposit or withdrawal fees, and foreign transaction fees.

However, none of these fees are a problem with cryptocurrency payments. While the percentage of the fees charged by banks appears minuscule, they can accumulate into a considerable amount over time, or when the amount being transferred is relatively large.

Making these payments using a cryptocurrency allows bypassing these fees. Plus, there’s no lag in payments either. The payments are processed almost instantly and the receiver will likely receive the coins in their account in less than a minute.

Although the cost-effectiveness of payments has nothing to do with generating returns, they can increase the overall ROI on a person’s crypto holdings given the savings in fees. This is especially true for people transferring large amounts frequently.

Ready to Onboard the Crypto Train?

Investors that want to get some of the crypto action should get in while the party lasts. Blockchain technology is about to revolutionize the world and investors stand to gain from the consequent increase in the value of crypto coins.

If it looks like the world is losing its mind with crypto, it’s because everybody wants to make money. This is fair, of course, as long as investors realize the degree of risk they’ll be taking by putting money in a cryptocurrency. If an investor invests money that they’ll need in the short term, or in worst cases invests their emergency fund, they’re putting their financial well-being in grave danger.

As long as an investor walks into the cryptoverse with their eyes wide open and a solid strategy, they’ll likely walk out with substantial gains. The more time they stay invested also has an impact on the overall returns. To survive through phrases of volatility, investors need thick skin. A panic-induced sell decision can translate to some serious losses.