Navigating international tax compliance is a formidable challenge for any enterprise operating across national borders.

This article unpacks essential strategies to simplify this complex landscape, focusing on things like understanding legal obligations, leveraging cutting-edge technology, and building a proficient internal tax team. These insights will guide you through the common pitfalls of international taxation and help harness opportunities to improve your compliance posture while benefiting from global operations.

Understand Your Compliance Requirements

When dealing with international tax compliance, the initial step is clear-cut: understand your specific obligations. Different countries harbour diverse tax regulations – what operates seamlessly in the UK might trigger complexities in the US or other regions, for example.

Engage with local experts and leverage their knowledge to navigate these waters effectively.

A simple strategy involves creating a compliance checklist tailored to each country where your business operates. This tailor-made approach not only streamlines managing obligations but also aids in spotting potential risks before they escalate into more significant issues (think of it as preventive maintenance for your financial practices).

Equipping yourself with this foundational knowledge paves the way for smoother operations across borders.

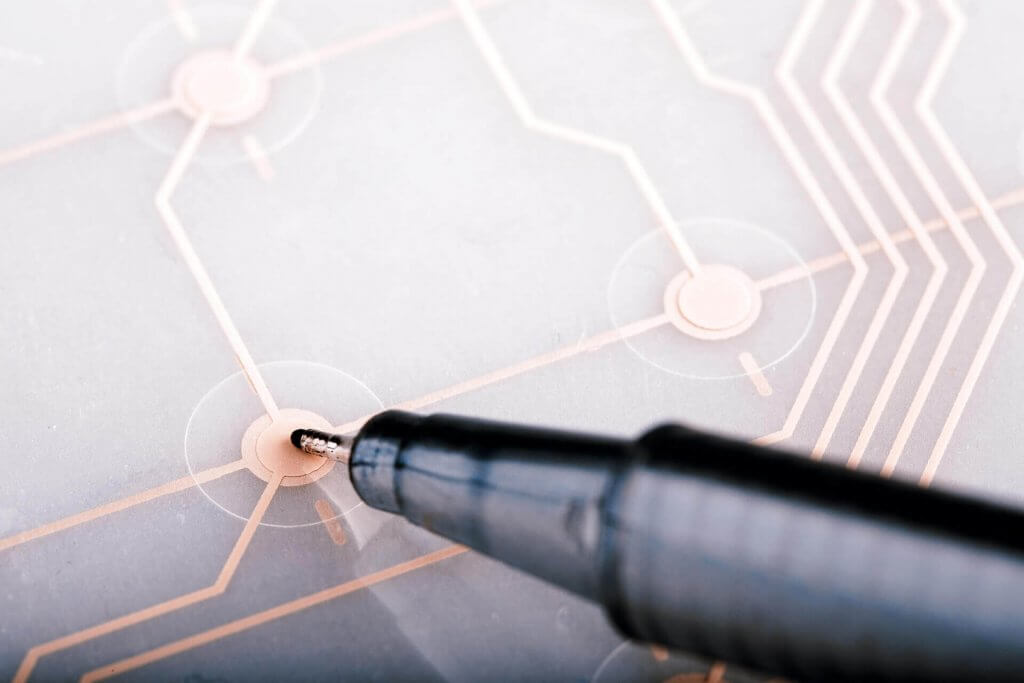

Leverage Technology for Efficient Tax Management

In the realm of international tax compliance, integrating advanced technology can significantly ease the burden. For instance, UK businesses operating internationally might consider tools like TaxCalc, which offers a comprehensive suite of modules tailored to handle complex tax scenarios, including non-resident tax calculations and VAT management.

Meanwhile, US expatriates can file taxes using specialised platforms like Expatfile, which provides tax software that Americans abroad can use to quickly e-file their expat tax returns and FBAR.

Such tools are indispensable. By adopting these sophisticated solutions, businesses can reduce errors, save time on manual processes, and ensure they meet all regulatory requirements without missing a beat. Harnessing this technology effectively equips companies with a robust framework to manage their international tax duties efficiently.

Build a Robust Internal Tax Team

For enterprises stretching across borders, assembling a knowledgeable internal tax team is crucial. Here’s how you can ensure your team is up to the task:

- Recruit with Diversity. Include experts familiar with the specific tax laws of each country in which you operate.

- Adopt Continuous Training. Tax regulations evolve; keep your team updated through workshops and courses.

- Implement Cross-functional Collaboration. Encourage regular interaction between your tax professionals and other departments to foster a more comprehensive understanding of your business operations.

This strategy not only bolsters your compliance capabilities but also enhances strategic planning and financial efficiency across the board.

Understand International Tax Treaties

Navigating international tax compliance efficiently often hinges on understanding and utilising tax treaties between countries. These agreements can provide substantial benefits, such as reduced withholding taxes on dividends, interest, and royalties, or the elimination of double taxation.

Before entering new markets or making cross-border transactions, thoroughly analyse the relevant treaties to discern how they can be leveraged to your advantage. Partnering with legal experts who specialise in international tax law can help decipher complex treaty language and implementation strategies.

By strategically applying these treaties, businesses can significantly mitigate their overall tax liability while remaining compliant with global regulations.

Stay Ahead with Proactive Compliance Monitoring

Staying compliant in the dynamic landscape of international tax laws demands proactive monitoring. Implementing a robust system that regularly reviews and updates your compliance status across all operational territories is essential. This approach should include regular audits, real-time reporting, and swift adaptation to legal changes.

Utilise analytics tools to foresee potential non-compliance risks and address them effectively before they develop into larger issues.

Remember, the cost of preventive measures is often significantly lower than the penalties for non-compliance. Keeping a vigilant eye on evolving tax laws not only safeguards against financial repercussions but also reinforces your reputation as a trustworthy global business.

The Takeaway

In essence, mastering international tax compliance is less about reacting to challenges and more about strategic foresight and robust preparation. By doing things like understanding specific country obligations, integrating technology for efficiency, and maximising benefits from international tax treaties, enterprises can navigate this complex field effectively.

Equip your operation with the right tools and expertise to not just survive but thrive globally, turning potential tax pitfalls into opportunities for growth and stability.