Planning for Future Financial Security

An international consulting firm with offices in London, Miami and New York, Intercorp Group serves high-networth entrepreneurs and their families, finding solutions to often very personal issues. Founded by Leonardo Braune, discover why this firm’s success has to led to his recognition as one of the UK’s leading tax and wealth planning consultants for 2019.

Finding professional solutions to personal issues for ultra-high-networth clients, Intercorp has established its expertise in many areas of problemsolving, not just tax and wealth planning. The firm offers a wide lens approach to strategy consulting, investing a great deal of time and energy into understanding each client’s unique requirements before evaluating their complex, multidisciplinary and global needs.

Originally founded as a tax consultancy, Intercorp has since grown to incorporate a greater breadth of services. The heritage of being a tax consultancy has enabled the firm and founder Leonardo to develop a much deeper understanding of their clients and their unique requirements, including everything from investment structures to interpersonal relationships.

A primary concern of high-net-worth families is ensuring that their wealth continues to be sustainable, protected both now and for future generations. As a result, many families have long mobilised their assets internationally, safeguarding them against political, economic or social instability. Intercorp’s consultants have at their disposal a number of investment vehicles and structures, each of which can have a positive impact upon the tax liability of the investments they support.

“Intercorp’s advisory and consultant services work primarily on the tax efficiency of structures, with client assets exceeding ten billion dollars.”

Always in full appreciation of tax legislation and the objective of the investment, Intercorp is committed to keeping abreast of developments in these areas to ensure that the consultancy it provides is always in line with any changes in the wider landscape. At the heart of this is a tax efficiency programme, which taps into the firm’s comprehensive knowledge of jurisdictional rules to identify the best opportunities for return on investment.

Specialising in providing bespoke services for ultra-high-net-worth individuals, Intercorp works to establish clients’ unique needs first and foremost, before providing appropriate frameworks to help them reach their goals. From structuring investments in frontier and emerging markets, to protecting assets and planning for the future, the firm draws on its internal expertise and extensive partner network to plot the most efficient path to success.

Through a rigorous understanding of clients’ businesses, coupled with global knowledge of the economic climate, a robust network of trusted specialists, entrepreneurial spirit, and multidisciplinary skill set, Intercorp has become a unique and sought-after partner.

At the head of the firm is founder Leonardo Braune. Intercorp was established under the supervision of Leonardo, with the sole objective of becoming one of the few truly international tax consulting boutiques. Delivering only the most efficient and practical solutions, this leading consultant has ensured his firm is fully capable of providing high quality tax, estate planning and fiduciary structuring services.

Leonardo himself is a highly-respected and experienced consultant in the areas of international tax, real estate planning, wealth preservation, fiduciary advice, implementation and management of international structures and projects. With vast experience in tax, and an extremely diverse client base, he has cultivated an atmosphere of success within his firm.

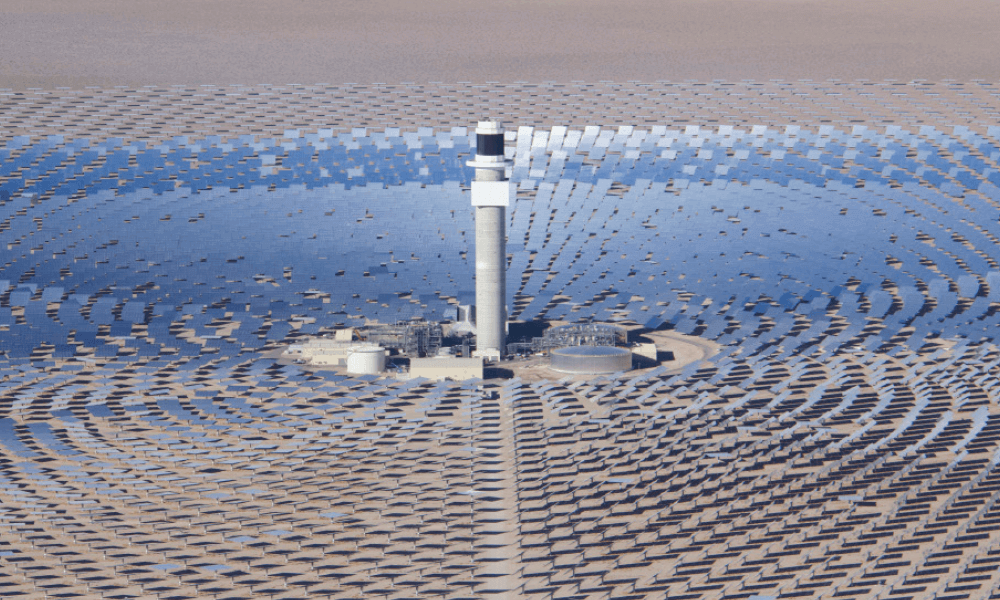

Leonardo has led on a number of successful projects in several industries, which has equipped him with the knowledge to help the ultra-high-net-worth clients his firm specialises in. Having worked successfully in oil and gas, telecommunications, real estate, international services, investment funds, and asset management, Leonardo’s more than twenty years’ experience make him worthy of international recognition.

Intercorp’s advisory and consultant services work primarily on the tax efficiency of structures, with client assets exceeding ten billion dollars. Another aspect of the service is coordinating the formation and compliance to local and international legislation for over 1,500 legal entities, more than eighty private investment funds and over two hundred private family trusts.

For each unique ultra-high-net-worth individual, whose worth often exceeds 100 million dollars, Intercorp approaches them as individuals. In taking the time to establish a relationship of trust and understanding, the firm creates a bespoke team of specialists that can handle any issues with grace, dignity and the discretion often required by the individuals and their families.

The staff at Intercorp play a vital role in ensuring the continued success of the firm and Leonardo. Without the staff’s hard work and dedication, the firm wouldn’t be able to deliver the high-quality and first-class service to clients. The company was formed on the ability to foster close and trustworthy relationships with clients and partners alike, and this is down to the continued passion and growth of Leonardo and his talented team.

As with many businesses operating in and around the United Kingdom right now, there is a great deal of uncertainty revolving around the impending effects of Brexit, and the UK potentially leaving without a deal in place. It is this uncertainty which continues to be a primary concern for Intercorp and its clients. Although the United Kingdom has long been the preferred location for high-net-worth individuals for many years, Brexit is forcing them to reconsider their options.

Brexit poses a threat for entrepreneurs’ ability to plan for the future, and this lack of clarity is driving some and their families to consider different cities for relocation. Intercorp works closely with ultra-highnet-worth individuals and their families to help them understand their options and put the right contingency plans in place.

Being a global organisation, Leonardo and Intercorp have a unique understanding of local laws, cultures and customs for cities across the world. This knowledge allows the firm to help its clients navigate through the challenges of relocating, whilst continuing to support them after they have moved into their new home.

The undeniable success of Intercorp is down to the culmination of all the moving parts serving the client in the best possible way. With bespoke teams designed to help manage ultra-high-net-worth clients’ financial portfolios, this consultancy firm is securing families financial future despite the uncertainty of Brexit and the current economic climate.