In today’s fast-paced industrial landscape, acquisition strategies have become the lifeblood for many companies aiming to expand their global footprint. By merging with or acquiring another company, businesses can swiftly penetrate new markets, acquire new technologies, or strengthen their supply chains.

One might wonder what role manufacturing, specifically molding, plays in this strategic dynamism. Interestingly, the art of molding, especially custom plastic injection molding, has become a cornerstone in many global acquisition strategies.

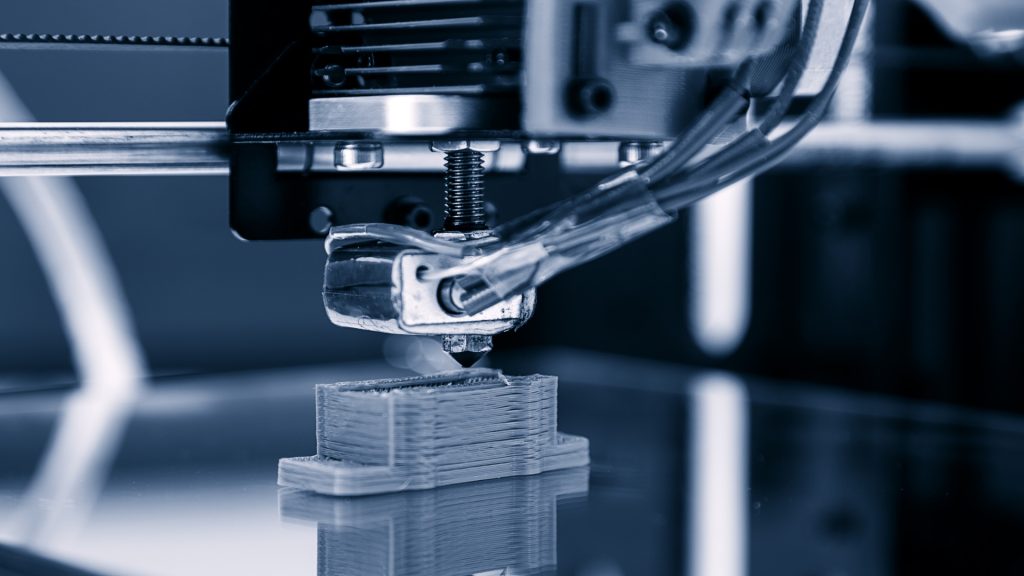

Understanding The Basics: What Is Custom Plastic Injection Moulding?

What exactly is custom plastic injection moulding? Well, think of the myriad plastic products you use daily – from your phone case to the buttons on your remote. Many of these items are created through a process known as plastic injection moulding. Custom plastic injection moulding tailors this process to produce specialized and unique plastic parts for various industries.

How Moulding Drives Acquisition Decisions

When you’re considering acquiring a company, countless factors are at play. Here’s why custom molding capabilities can be a game-changer:

1. Scalability Potential

One of the most critical considerations when acquiring a company is its growth potential. Companies with robust custom molding capabilities can quickly scale up production, adding a significant asset to the acquiring company. This scalability potential ensures the acquiring company can meet increasing demands without hitches. Custom molding capabilities enable companies to increase their production capacity, maintain quality, and optimize efficiency, ultimately enhancing their competitiveness in the marketplace.

2. Diverse Product Line

Acquiring a company with a diverse product line offers a significant advantage to the acquiring company. Custom molding allows for producing unique, tailored products that meet specific market needs. A company with robust custom molding capabilities can produce different products, ensuring they are not boxed into a specific niche. Acquiring a company with a broad range of molding capabilities helps to broaden the acquiring company’s product offerings, enabling them to better serve their customers and capture a more significant share of the market.

3. Reduced Costs

Reducing costs is a critical consideration when considering acquisition decisions. Custom molding can lead to economies of scale, resulting in cost-effective mass production. By taking advantage of the advantages of custom molding, companies can reduce material waste, minimize labor costs, and optimize overall production efficiency. The cost savings achieved through economies of scale can bolster the bottom line, making the acquisition a financially viable option.

Linking Moulding Capabilities To Market Penetration

One of the principal aims of acquisitions is to penetrate new markets. Suppose you’re eyeing a market where plastic products are in vogue. Having custom moulding capabilities can be your trump card. It ensures you can cater to local demands, produce region-specific products, and adapt to changing market dynamics. This flexibility can differ between establishing a foothold and being edged out.

Evaluating Technological Advancements In Moulding

The world of molding isn’t static. Technological advancements are continuously shaping and reshaping the industry. When considering an acquisition, you need to assess the technological capabilities of the target company. Are they at the forefront of molding technology? Can their machinery produce intricate designs with precision? Answering these questions ensures you’re not just acquiring a company but also a competitive edge.

Prioritizing Sustainability In Moulding

Today, sustainability is a business imperative. With consumers becoming more eco-conscious, companies are pressured to adopt green practices. In custom molding, this translates to using recyclable materials, minimizing waste, and optimizing energy consumption. If your acquisition target prioritizes sustainability, you’re gaining an ethical edge and catering to a growing market segment that values eco-friendliness.

Integration Challenges And The Role Of Moulding

Acquiring a company with mold capabilities can be challenging due to the integration challenges that arise from the acquisition. These challenges can stem from machinery compatibility issues, employee training requirements, and the need to standardize production processes. Integrating the acquired company’s mold capabilities requires careful planning and coordination to avoid disruptions and ensure a seamless transition. Recognizing these potential challenges beforehand helps in developing strategies to tackle them effectively. The acquiring company must conduct a thorough assessment of the acquired company’s mold capabilities to identify areas that might require adjustments to ensure a smooth integration process.

Conclusion

Moulding, especially the custom variety, plays a more pivotal role in global acquisition strategies than one might initially perceive. From offering scalability and market penetration advantages to acting as a barometer for technological and sustainability prowess, it’s clear that moulding capabilities can significantly influence acquisition decisions. As you navigate the complex world of acquisitions, remember the value of moulding and how it can shape your global ambitions.