The Global Tax [r]Evolution

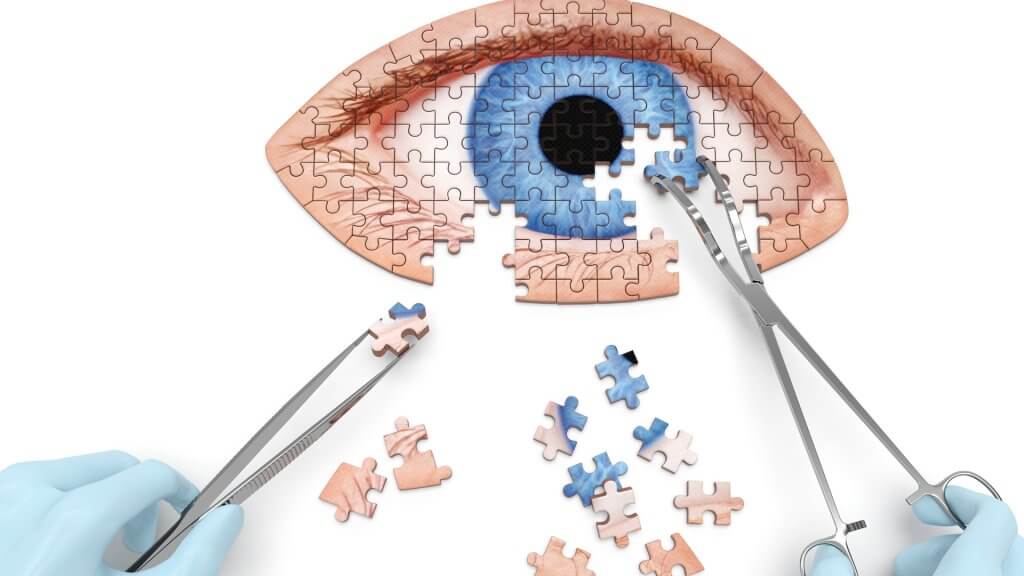

One of the consequences of operating in an increasingly globalised and digitalised world, is that borders blur and taxing rights between countries become a hotly contested topic.

Over the past five years, Deloitte has commissioned biennial research with global tax decision-makers in response to the changing global market dynamics. With over 1,000 organisations surveyed, Deloitte’s recent Global Multi-national Survey found that 52% of organisations cite BEPS and OECD legislation as their biggest area of concern. Furthermore, 93% of respondents agreed media and political interest in tax in their country had increased, while 74% said their organisations were concerned about increased media, political and activist group interest in tax.

It is clear that successfully navigating the new global tax environment is becoming riskier and more challenging for multinational enterprises. Only those that develop strategies to respond to current and anticipated tax changes, assess and quantify tax risks so they can identify key focus areas and improve their stakeholder management, will be able to ensure they are not thrown off course.

No doubt an increase in cross-border trade is one of the best ways to ensure more stability for regional economies – but it cannot happen in isolation. A joint effort is needed and then the desire to make it happen.

With 32 offices across 15 African countries, Deloitte Africa is well positioned to assist multinationals operating across the continent, providing a range of fully integrated tax services, combing insight and innovation from multiple disciplines with business and industry knowledge.

![Article Image - The Global Tax [r]Evolution](https://acquisitioninternational.digital/wp-content/uploads/2018/07/b59ea84e-0c19-4332-9436-82f948335d22.jpg)