Third-party data? Who needs it?

A cookieless future and the third-party apocalypse have been discussed extensively over the last few years, starting with Apple Safari depreciating cookies in 2017 with intelligent tracking prevention (ITP).

Whilst Google announced they are no longer removing third-party cookies from Chrome, there will be changes to how users control their privacy settings. With this in mind, now is the time to review your zero- and first-party data strategy to help fuel your marketing strategy now, and in the future!

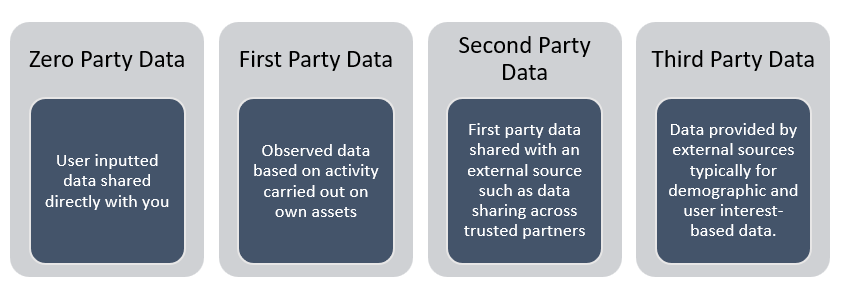

The different types of cookies

What is zero-party data?

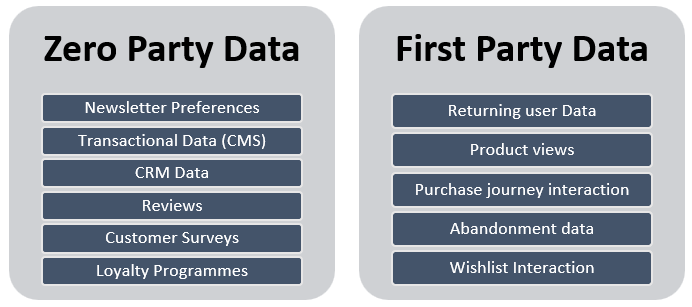

Zero-party data is information willingly provided by users to share their input. This is often in the form of surveys, preferences for sharing information, and user-generated content. Essentially, it’s data shared by the user directly with you.

What is included in zero-party data?

- Surveys

- Online submitted forms

- Content and personalisation preferences such as newsletter preferences

- User-generated content

Why is it important?

This kind of data provides up-to-date analytics and insight into your users based on what they are interested in. This means that it can be utilised to shape your offering and positioning. It allows you to collect qualitative data, providing insight into sentiment and views of your offering.

It ultimately allows you to get closer to the views, interests, and requirements of your users and consumers.

Advantages of zero-party data?

The main advantages of zero-party data are:

- Accuracy and Credible Source – Users are providing information about themselves. This is more likely to be accurate than trend data, but some bias may occur.

- Up-to-date Information – Unlike industry trends and reports, you can gain the latest views of your users and consumer

- Privacy – Users are willingly sharing this information with you which means this is privacy compliant.

What is first-party data?

First-party data refers to observed data from interactions from an asset you own such as your website or app.

What is included in first-party data?

First-party data comes in many different forms, each has its own use case to enhance your strategies with user insight:

- CRM data

- CMS data

- Form inputs

- Subscriptions and newsletter signups

- Search forms

- Web analytics

Why is it important?

First-party data provides the opportunity to understand your users better by observing their activity on your site. With privacy setting changes to browsers, and the rise of adblockers, this information (if collected with consent) can provide valuable insight into your consumers. It allows you to adapt your offering based on demand and what is important to your users.

It can provide you with up-to-date information on your consumers enabling you to adapt to shifts as they happen. But, don’t be mistaken – it’s not just for customer acquisition, first party data can also be used for nurture campaigns and customer retention strategies.

What’s the difference between zero-party and first-party data?

Zero-party data is the user explicitly sharing information with you, whereas first-party data is the observation of interactions and activity that is occurring on your owned assets such as a website or app.

Collecting zero- and first-party data and consent. What needs to be considered?

Privacy

Whilst zero-party data is willingly shared, (usually in exchange for something of value to the user) it’s important to communicate how you will use the data they are sharing with you. This is important to reinforce trust.

Data Management

- Storage

If you are collecting continuous user data, it’s important that your data storage solution has the capacity required to evaluate the data. When choosing a storage solution, consider how long you need to store this information and if your platform has any data retention limitations. Consider how long you want to store this information

- Security

Due to the nature of data, zero-party data needs to be stored securely, ensuring you are protecting the user’s information. This personal identifiable information needs to be safeguarded. Ensure your data processing officer is consulted when reviewing the security requirements for storing user data.

When sharing data with your data analysis team, remove any personal data not required for the purposes of the analysis, such as name, address, contact information and, if applicable, payment information.

- Processing

Your data storage solution will need to be able to process your data for analysis. Ensure it’s stored in a format that can be broken down to analyse and extract insight.

- Analysing

Ask yourself, how will your team be analysing the data? As with all data collection, you need to invest in analysing the data too. Make sure when planning your first-party strategy that you plan how you are going to collect your data for optimal analysis, allowing your team to extract insight to provide answers to key questions.

- Reporting

How do you need to visualise learnings to stakeholders? Ensure your data storage solution is compatible with your chosen reporting platform to enable data to be visualised in an accessible way.

How can you use zero and first-party data?

For many years in the digital marketing space, we have relied upon user or customer-centric strategies, but with rapidly evolving technological changes to protect users’ privacy, historic methods may not work today. This is where a zero- and first-party data strategy comes into play.

1. Understand your users

- What they are interested in

If you’re a fan of Google trends or keyword research tools to establish shifts in demands, this technique is one for you. Zero-party and first-party data utilises the data shared by your users to understand what they care about the most. This gives you more relevant trend data for your business, adding an extra layer to your trend analysis. This data can be useful for audience analysis and profiling for future marketing strategies.

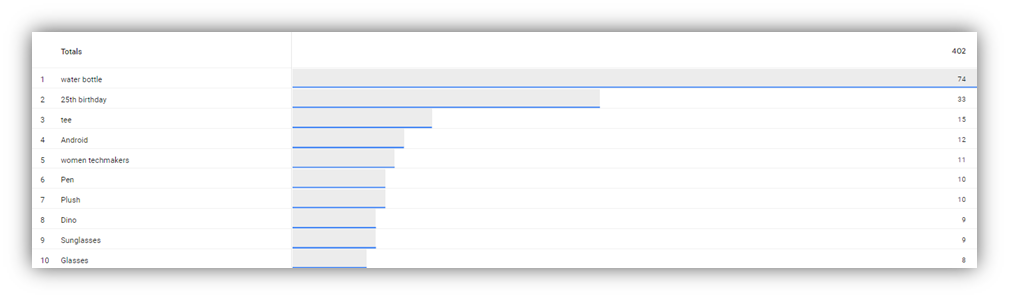

- What are your users expecting?

Utilising site search to establish what users are searching for on your site will help establish if your audience is expecting to find information about a product or offering that they cannot find. If it’s a product you do not offer, this can help with your offering.

Please Note: additional configuration is required to collect and display this information within GA4 reports. If your website meets GA4 criteria for site search enhanced measurements, you can access search terms by creating an Explore report using the dimension “Search Term”/

2. Understand early shifts in the market

- Shifts in market demands are often subtle and go undetected, but by listening to your users with the information they share, you can find shifts in user behaviour. Utilise customer forms, surveys and sales information. If you are an ecommerce site, utilise your order data to understand when users are buying the next seasonal trend. If you see an uplift in demand for a particular product type regardless of the channel, feed this back to your marketing channels. This allows adjustments to be made based on live data.

3. Futureproof your marketing strategy

- Adapt product offering and messaging

Once you have detected a shift in your customer behaviour and demand, it’s important to reflect on how your product or offering addresses that demand. This could cause a new category or area on your site; it could change the way you position your product.- D2C Example: Antibacterial cleaning sprays added “defends against covid-19” to address the need to reduce the spread of covid-19

- B2B Example: Marketing agencies introducing AI services to their offering to capitalise on the new technology, user demand and, in some cases the user’s expectation.

- Seasonality patterns and trends

Any early shifts in the market detected can be used to plan future strategies. For example, if you experience demand to start earlier than previous years, the change can be factored in for planning future years. This doesn’t need to be isolated with marketing, if you have a buying team, this data can feed into merchandising planning for future seasons.

4. Personalisation

Tailored preferences with consent provide the ability to personalise the user’s experience with the brand to show relevant content based on what they are interested in.

For example, an ecommerce newsletter will help determine the types of products the user is mostly interested in rather than assuming they are buying for themselves. This can result in higher engagement and conversion rates with targeted nurture campaigns.

Industry Use Cases & Examples

Use of zero-party data can be widely used across sectors and industries. Here are some examples of how companies can collect zero-party data to enhance their strategy.

Automotive

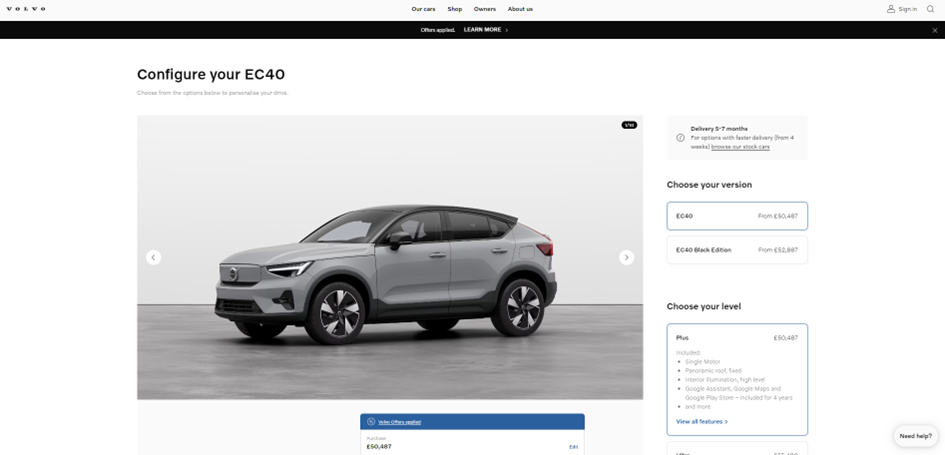

Ever configured your ideal car on a car manufacturer’s website? Added your favourite shade of paint, preferred alloys and interior…? So have thousands of other people – and you guessed it – this data is being used to influence decisions.

First-party data can be used to forecast products for manufacturing and to understand what features to call out when marketing products based on what is important to the user. For example, using the “build a car” website functionality that is present on most car manufacturers’ websites, these brands are able to understand the desirable features and functionality consistently selected when configuring a car.

Due to user behaviour, many users will initially add all desired features on a car and remove these features to align the price with their budget whilst keeping the features they must have.

Using first-party data to see what users have kept vs removed will help evaluate what consumers deem as essential features and nice-to-haves. This can be fed into research and development for future models as well as marketing to test if features need to be positioned differently.

Volvo

Using Volvo as an example, their “configure yours” functionality allows them to collect data on the following preferences:

- Type of vehicle – electric, hybrid and mild hybrid

- Model of vehicle – which models are most popular

- Vehicle paint colours

- Configuration options of the car – powertrain, wheels

- Uptake of optional packages or equipment

- Financial Option preferences – lease, purchase, subscription or personal contract purchase (PCP) or loan

- Purpose of use – Personal or Business

Using the build a car tool, Volvo has the ability to understand shifts in consumer demand for new product design and what consumer-desired features to shout about in product advertising and product descriptions.

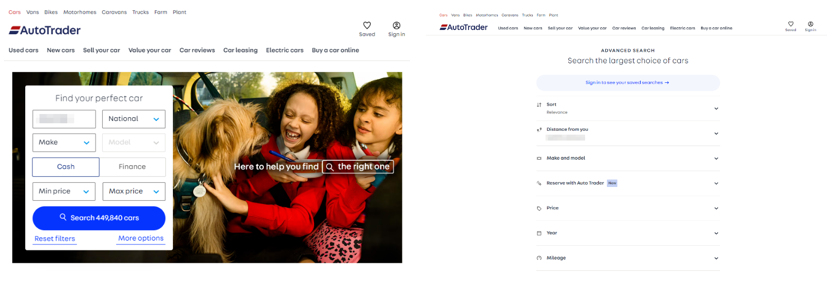

Auto trader

For car selling and buying marketplaces, the search criteria can be utilised to understand users’ requirements when looking for a second-hand car. This can take a similar approach to car manufacturers by using the user’s form input to understand popular criteria for cars. Using Auto Trader as an example, they can extract:

- Popular search criteria – what are users filtering by

- Popular Make and models

- Specific vehicle requirements such as body type, gearbox type, popular colours, number of seats

- Advanced filtering options selected – fuel consumption, Co2 emissions, tax per year, boot space

How to use

This can be used in marketing strategies by using the most searched make and model reflected in your marketing creative and assets for both buyers and sellers. Findings can be used to provide buying guides and content to aid the decision-making process.

Collect these detailed search selections within a database and evaluate popular selections over time. Does a user’s selection differ based on seasons, industry news or new legislation? Plot this data against changes in the industry to understand how consumers are reacting to changes in the industry.

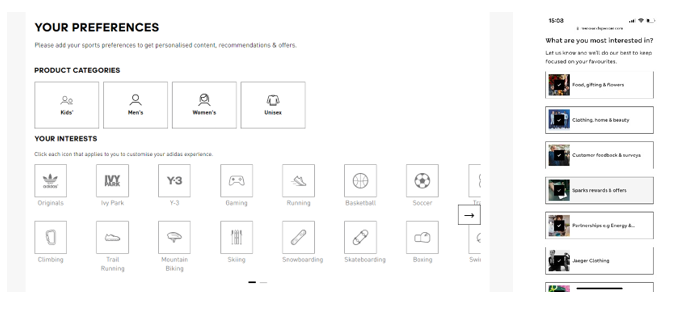

Ecommerce

Ever managed what information you want to hear about on an ecommerce site? Tailored your interests based on what product categories or brands you are interested in? Maybe you’ve used “What’s your size?” functionality, providing intimate details of your height and weight with details of other brands you buy from and their sizing. This all provides consumer insight into popular brands and product types which can be used by the retailer for the seasons ahead.

When engaging with online retailers, many users willingly share information about themselves directly with the retailer. This zero-party information can be used to understand your audience and to understand buying interests better. Functionality present on ecommerce sites encourages this data sharing from users.

How to Use

In ecommerce how you can utilise zero- and first-party comes in many forms, from gathering newsletter preferences to understanding user interests and products they are more likely to purchase. We provide a few ways ecommerce sites can utilise this type of data.

Newsletter Preferences

Source: https://www.marksandspencer.com/

Optimised ecommerce newsletter sign-up forms often ask for the user’s preferences on what they would like to receive. Not only does this provide consent to add the user to nurture campaigns, but it also provides insight into the products they are interested in. This can aid audience understanding and profiling but can also be used for nurture campaigns where consent has been given.

This can include:

- Department preferences – menswear, womenswear, childrenswear

- Product type

- Preferred brands

This can be used to help influence buying teams with real-time user data based on what they like. As part of an ongoing nurture campaign, this can be sent out annually to existing customers to update their preferences. This helps update your customer database with high-quality, relevant data.

Transactional data

As an ecommerce business, sales data collected by your CMS can provide insight into consumer trends from popular buying times to popular variants such as size and colour. But it can also provide buying behaviour trends when consumers start buying for Christmas or seasonal items and when that product’s demand stops. This trend data can feed marketing activity throughout the year to become agile to shifts in consumer behaviour.

This can include:

- Popular sizes

- Popular variants

- Product type buying trends

- Popular buying times

Sharing this data with your buying team means it can be utilised to understand when activity needs to take place, and what to include in placements and lookbooks for each season.

CRM Data

Similarly to CMS data, CRM data holds data about who your converting audience is. This can unlock a deeper understanding of who your audience is, and what the lifetime value (LTV) of those users are.

This can be used to understand your audience better, who are you reaching and encouraging to purchase with you?

Reviews & Customer Surveys

Customer reviews have value across many different levels, as well as influencing other users to decide if the product is right for them, it can provide feedback on your offering. Alongside customer surveys, often users will provide details about what they like and dislike about a product, a retailer or the service received.

At scale, this can provide insight into areas an ecommerce site needs to improve. If addressed, the pain points previously felt by customers can be addressed in positioning and marketing.

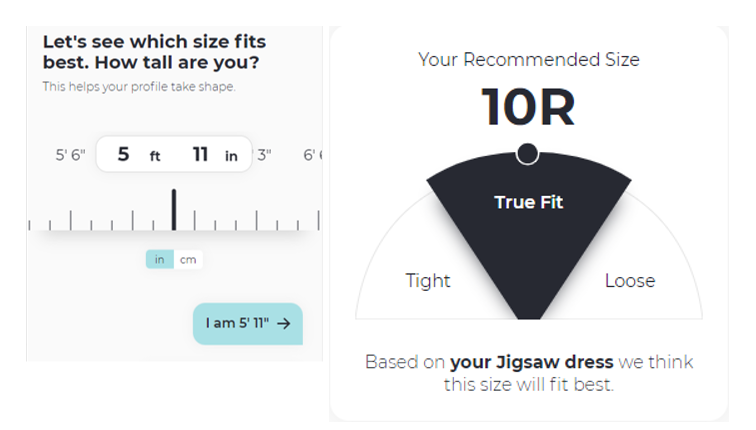

Size Guides

Many fashion sites use “What’s my size?” functionality where the user enters their height, weight, age, brands, typical sizing bought, fit preferences. This offers the user a personalised size guide.

Loyalty programmes

Many high street retailers offer loyalty programmes to their customers. Think Boots, Marks and Spencer’s, Tesco’s, and Space NK to name a few. This is often an exchange of rewards and benefits for loyalty and data sharing.

Loyalty programmes become more applicable for those with a physical store presence with the ability to understand user activity only and in-store.

This data can help your business understand user behaviour, such as how far someone travels on average when shopping at your store, if click-and-collect shipping options are available, and how far are customers likely to travel. This information can be used to plan future stores or help strategize future business decisions.

Conclusion

Zero-party data should not be a forgotten source of insight into your consumers. It can be utilised by a multitude of industries and sectors. Most companies collect this data, but the question is, if you are collecting this data, are you spending the time to learn from it to provide up-to-date insight into how consumers’ requirements and interests are changing? How frequently is this being shared with the different stakeholders in the business to influence the products, the positioning and marketing?

If this is not something currently utilised, I urge you to incorporate it into your next strategy to not only listen to your consumers but use it to help futureproof your business too.